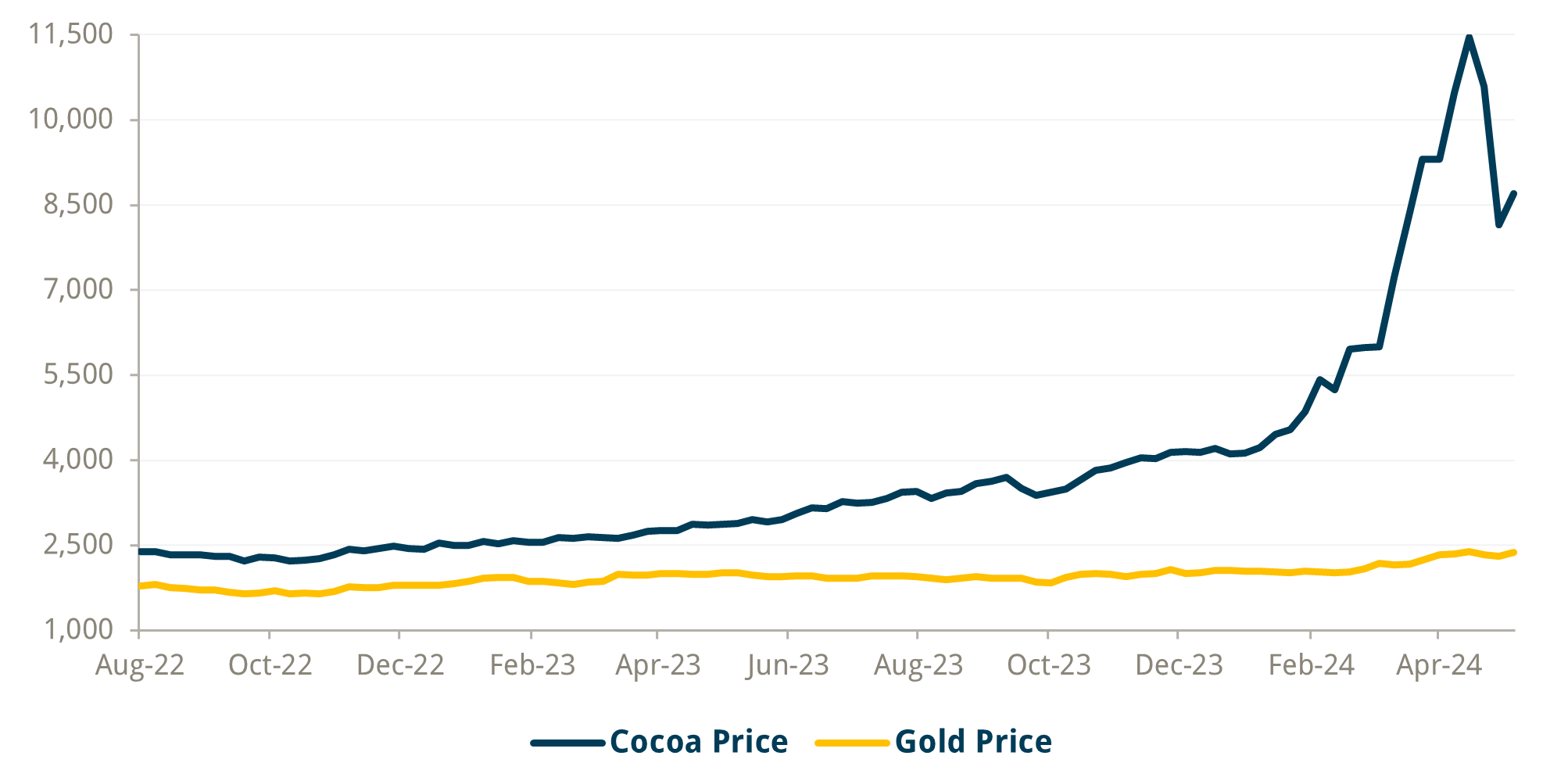

Cocoa, an often-forgotten commodity, has been at the forefront of financial news lately, for perhaps all the wrong reasons. Cocoa’s price has risen 4x since a year ago, and while strong, multi-year rallies in commodities are quite common, the speed and strength of Cocoa’s moves is something else, putting crypto, gold and even the magnificent seven’s performance to shame. As agricultural commodities go, the Cocoa bean is of little significance; it is not a staple food but just a pleasant chocolate treat. But this little bean, as it shoots the moon and beyond, has a cautionary tale to tell: a warning shot against monopoly.

Source: Trium Capital & Bloomberg

The Cocoa market is dominated by two large producing nations, Ghana and the Ivory Coast. The Cocoa harvest in these countries has been poor over the last two years, and the official narrative is that heavy rain and a fungal blight, which comes with the overly damp conditions, have created a global Cocoa deficit.

On the surface, this is nothing unusual: agricultural commodities are always susceptible to the vagaries of irregular weather patterns (and the pathogens that come with them) and expectations for weather and its impact on yields routinely get priced into commodity futures curves. It is always the case that for any market with inelastic supply, deficit-driven rallies are often explosive and certainly not uncommon. So, with poor growing conditions set for a third year, it seems reasonable to assume that the current rally in Cocoa was purely supply deficit driven.

But what transpired in the Cocoa markets was not this: something else aside from supply problems was at play to drive Cocoa to the dizzy heights that even Bitcoin would blush at.

For when it comes to the Ghanaian Cocoa trade, there is really no market. There is just the Ghanaian Cocoa Board (a government-controlled institution), which is the only buyer of Cocoa in Ghana – Ghanaian farmers are legally required to sell their stock to it. In return, the board pays a fixed price to the small-hold farmers.

It is this ‘fixed price’, although decided from just a simple stroke of a government-held pen, that has led to a sequence of events that has called into question the integrity of the entire global Cocoa trade1.

The problem stems from the fact that the fixed farmgate price is just a tiny fraction of the international price. The farmers, quite rightly incensed that there has been no pass-through of Cocoa price gains, have slowed their delivery to government warehouses – Some farmers have taken to smuggling their crop to the Ivory Coast for a markup2. Few, if any, farmers can afford fertiliser or pesticides, nor have they replaced the diseased trees to tackle the fungal blight. And worst of all, new trees and plantations for future harvests have been eschewed to give over the land to illegal mining for rare earth and precious metals, the slurry from which renders the Cocoa farms baron for evermore.

A rising market price should incentivise a supply response, but the sad reality is that the higher the global Cocoa spot price goes, the less the Ghanaian farmer delivers to the government, and the worse the prospects for future Cocoa production become.

While the perverse incentives of the fixed farmgate price are a travesty for the Cocoa farming community and the local environment, the malign influence of incentives can move up the value chain as well as down. The now panicked Ghanaian government claims that it cannot pay the farmers a higher price as it had sold forward 70% of the nation’s crop. Yet local independent press report that the government did no such thing, that only a small fraction of the nation’s crop was sold forward3, and that the government has earned the full spread between the farm price and the global spot price, a markup that has been duly pocketed. If true, a tidy earner for sure.

Furthermore, on the discovery of the alleged ‘theft’ came the inevitable erosion of trust with international buyers as (seemingly well-founded) rumours began to circulate that the Ghanaian government’s delivery on the current futures contracts was less than certain.

This time, it was the turn of the consumers (chocolate manufacturers) to panic, and they bid up the near-term contracts by some 600% in a desperate attempt to secure near-term delivery. ‘Best to stockpile as much physical Cocoa at any price now rather than take a gamble with future delivery’ was the thinking. This is the psychology of a bank run: if a bank is rumoured to be in trouble, the ONLY rationale response is to take your money out, or in the case of Cocoa, the only rationale response is to hoard as much Cocoa as possible.

However, with the chocolate manufacturers in ‘bank run’ mode, the curve completely dislocated, which set off the next domino to bow out: the speculators. The primary utility of any futures market is to provide price stability across time between consumers and producers whose demand (chocolate consumption) and supply (cocoa harvest) do not line up. While speculators’ incentives are profit-seeking, as a collective, they provide the oil for the smooth function of the futures market across time, and without a functioning futures market, consumers and producers cannot plan and budget long-term, which only exacerbates any supply deficit issues.

As the futures curve contorted beyond recognition and volatility exploded, stop losses were first triggered by time-spread investors (those who trade short-term vs long-term futures). Those with outright positions in Cocoa also reduced positions, either in response to increased volatility or due to higher margin requirements imposed by the exchange. Rather than chase a monumental bull run, speculators, as a collective, have exited Cocoa, further reducing liquidity and amplifying curve dislocations. As it turned out, not very ‘speculative’ behaviour at all.

It is not clear when or if the Cocoa market will ever return to normality. Growing new Cocoa trees is as slow as government reform, and both need to happen before any resolution can be reached. With no end in sight to the structural deficit, it is not clear when the futures markets will begin to function as before.

As such, the Cocoa market debacle looks set to become a textbook case study of how price fixing in markets inevitably leads to corruption, destroyed trust, broken supply, panicked demand, and ultimately, the degradation of all productive resources. One does wonder as to which other price-fixed markets have similar perverse incentives baked in. Perish the thought that Cocoa’s performance does not repeat in a staple food market. I suppose one can at least rest assured knowing that the regular fixing of the price of money, the central bank’s interest rate, has absolutely no parallels with Cocoa’s cautionary tale.

______________

- https://www.reuters.com/markets/commodities/ghana-hikes-20232024-cocoa-farmgate-price-supplies-tighten-2023-09-09/

- https://www.bloomberg.com/news/articles/2024-04-03/ghana-considers-hiking-cocoa-farmgate-price-to-curb-smuggling?embedded-checkout=true

- https://starrfm.com.gh/2023/11/cocobod-ceo-lied-over-cocoa-forward-sales-minority/