• We may be on the verge of an unprecedented shipping crisis as a combination of climate change and geopolitics disruptions ensues. This is a longish-term trend, part of the broader global supply chain troubles, a process whose effects may be brought forward this year, depending on what happens in the Middle East and, indeed, who wins the White House in the US.

• The winners that benefit from these disruptions are obviously commodity exporters and, in general, trade surplus countries. The losers are likely to be Europe and countries with trade deficits. Globally, we are likely to see higher inflation.

• After more than four decades where economic growth was the predominant occupation of central banks, we are entering a period dominated not only by higher inflation but also by higher volatility of inflation.

Shipping costs and maritime choking points are back in the news this year. Beyond their short-term impact, which may prove to be passing, there is a longer-term shift which should not be underestimated. During Covid, shipping costs rose considerably on the back of mostly logistical issues, bourne by the fact that people were out of work, for example. Then costs came crashing down as soon as some of the pandemic restrictions were lifted. It is possible, however, that shipping costs are today at the beginning of a structural increase due to climate change and geopolitical considerations, including shifting global supply chains. In other words, global trade is about to become much more volatile.

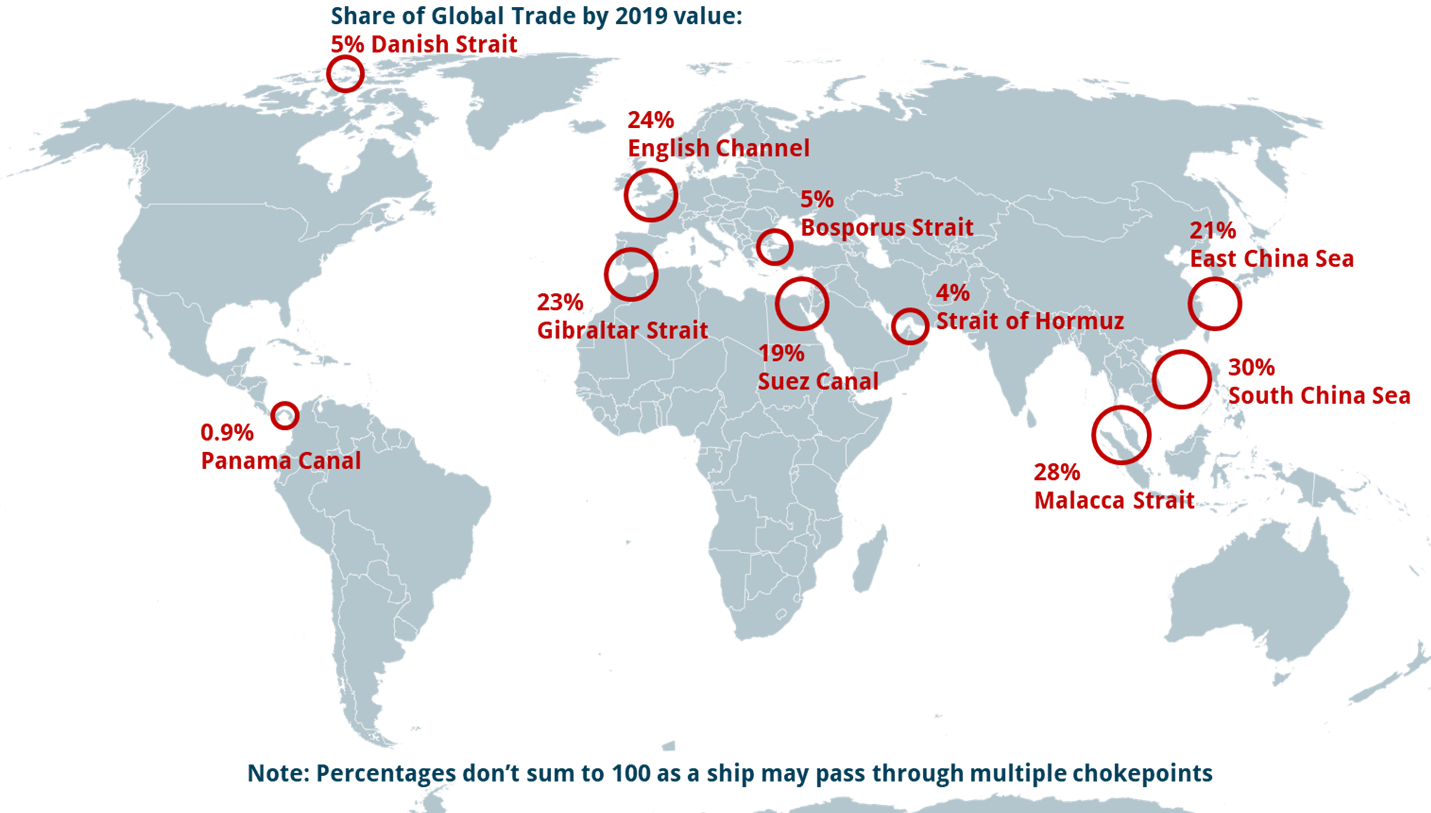

These are the major maritime choking points globally:

Source: Lincoln Pratson of Duke University; Statista, Bloomberg & Trium Capital

• The Strait of Hormuz is controlled by Iran.

• The Suez Canal and the Bab el-Mandeb Strait, as part of the Red Sea route connecting Asia and Europe, are partially blocked.

• The Panama Canal, linking the Atlantic and the Pacific Ocean, is partially blocked.

• The Bosphorus is controlled by Turkey.

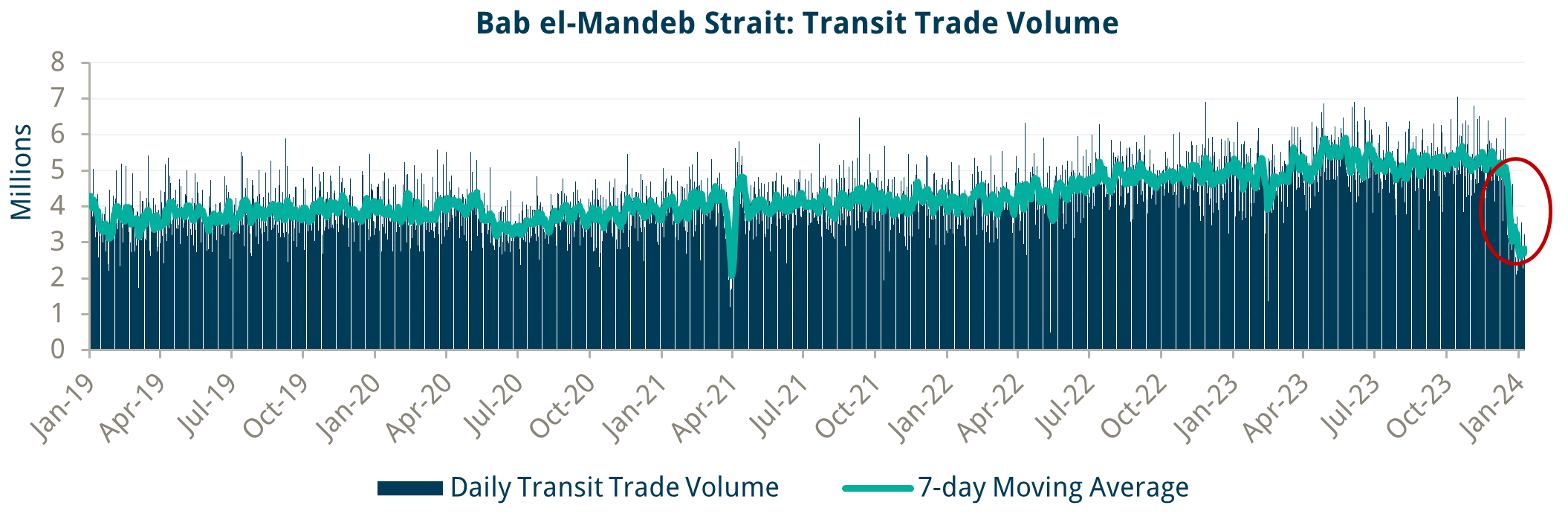

To avoid the Red Sea, ships must go around the Cape of Good Hope, which is the most dangerous crossing, according to experts, due to very high waves and rough sea conditions. The chart below shows the sudden drop in transit trade volume at Bab-el-Mandeb.

Source: IMF PortWatch and Trium Capital

But the crossing around Africa takes such a long time that most ships must refuel on the way. The problem is that few ports along the East Coast of Africa are suitable for doing this. In South Africa, for example, the major ports are also below global standards; in any case, they cannot accommodate all the traffic heading in their direction.

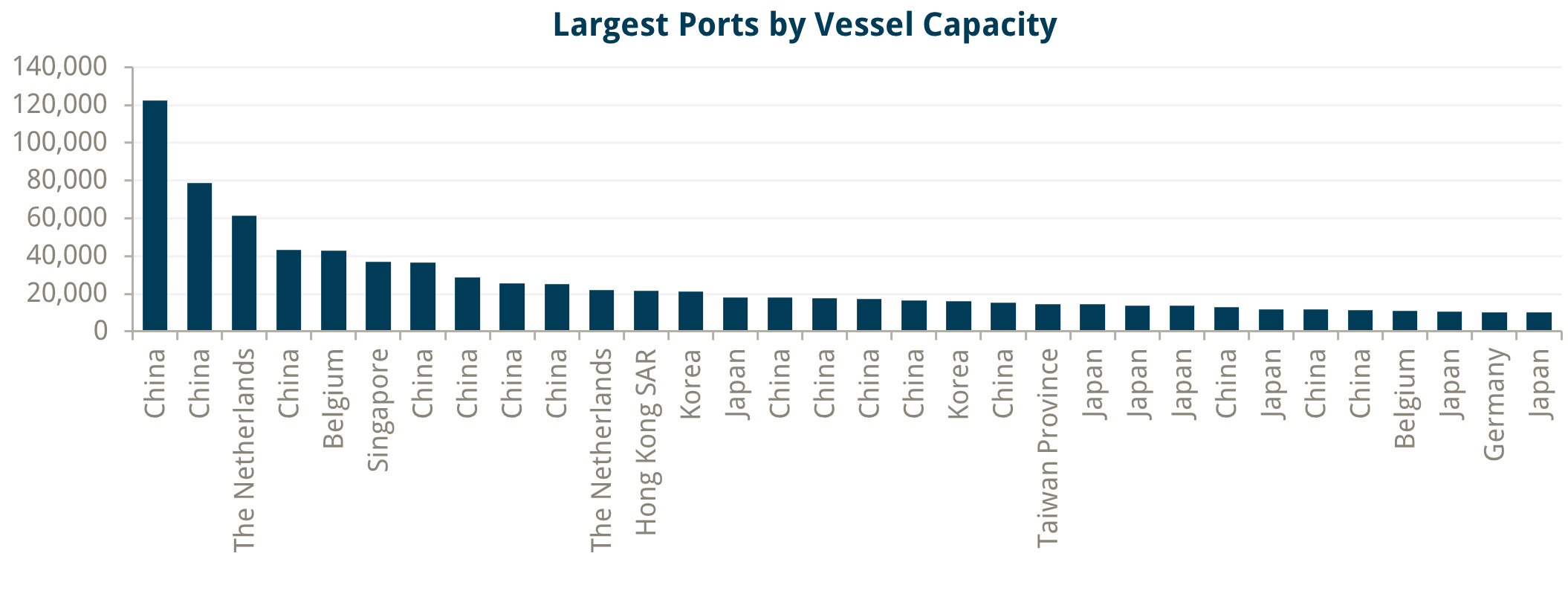

In fact, port capacity will become a global issue as supply chains start shifting in earnest. Of the 10 top ports globally (as measured by vessel count capacity), 7 are in China! Of the top 34, or those above 10,000 vessel capacity, there are only 5 outside of Asia (Rotterdam, Antwerp, Amsterdam, Ghent and Hamburg)! The top US port, Houston, is ranked 51st in the world and has a capacity of only 7,040 vessels.

Source: IMF PortWatch and Trium Capital

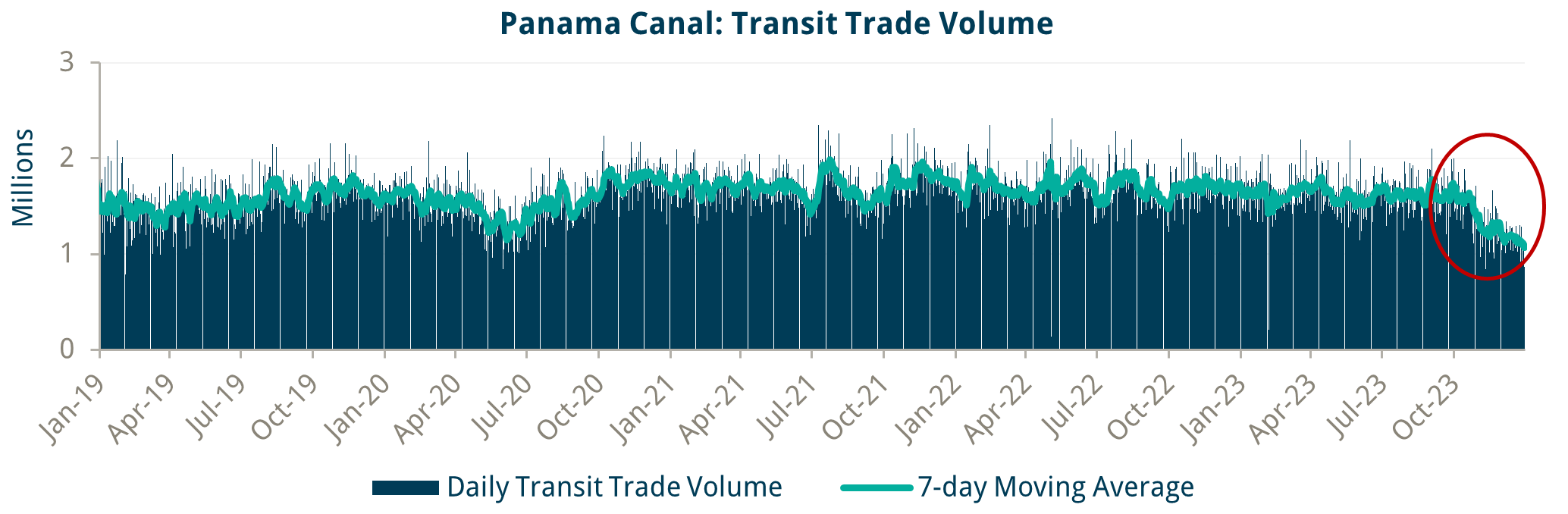

To avoid the Panama Canal, ships must go through the Strait of Magellan (at the bottom of South America). The chart below shows that the 7-day Moving Average of transit trade volume in the Panama Canal has collapsed since the severe drought began last year. Current levels are nearly half of what they were in 2019 when low water levels also caused massive bottlenecks.

Source: IMF PortWatch and Trium Capital

The Transit Trade Volume charts do not look that different. In fact, the same can be said for the Suez Canal and the Strait of Hormuz charts, as the result of the worsening situation in Gaza. The diversion required to avoid these ports also means companies now prefer to hire larger ships that can better withstand rough weather and do not need refuelling along the way. Rates for very large crude carriers (VLLC) booked for long-haul voyages have also started to increase1.

While the sea routes in the Middle East become ‘unpassable’ due to geopolitical risk, traffic through the Panama Canal is severely curtailed due to climate risk. The IMF, together with the University of Oxford, runs an excellent database on maritime risks, and they have added climate simulation to their analysis2.

According to their data, Europe, Japan, the US, and China are the top regions whose ports could be affected by climate risks of various sorts.

So, both climate risk and geopolitical risk make the sea routes more dangerous, the latter especially so if the US is not capable, or not willing, of policing these routes anymore. We had a brief glimpse of this most recently with the situation in the Red Sea. However, we suspect this issue will become more worrisome if Trump becomes the US president, given his stated political agenda3. And even if he doesn’t, it is not clear whether the US will be able to maintain the kind of military spending necessary to keep its fleet running given the large US government debt amassed after Covid and the continuous wartime support in Ukraine and the Middle East..

It is important to note that 80% of all goods worldwide are shipped by sea; if global trade switches to be primarily land-based rather than sea-based on the back of the issues mentioned above, then there is one potential big winner from it, and that is China with its Belt and Road Initiative. But that is a story for another time. For now, shifting global supply chains away from China, but keeping their beginnings within Asia, for example, Vietnam or Indonesia, only worsens the problem as these countries do not have the capacity (general transportation networks and manufacturing capabilities) to handle the size of trade. Onshoring or friend-shoring closer to final destinations (Mexico for the US, North Africa for Europe) will still run into similar issues.

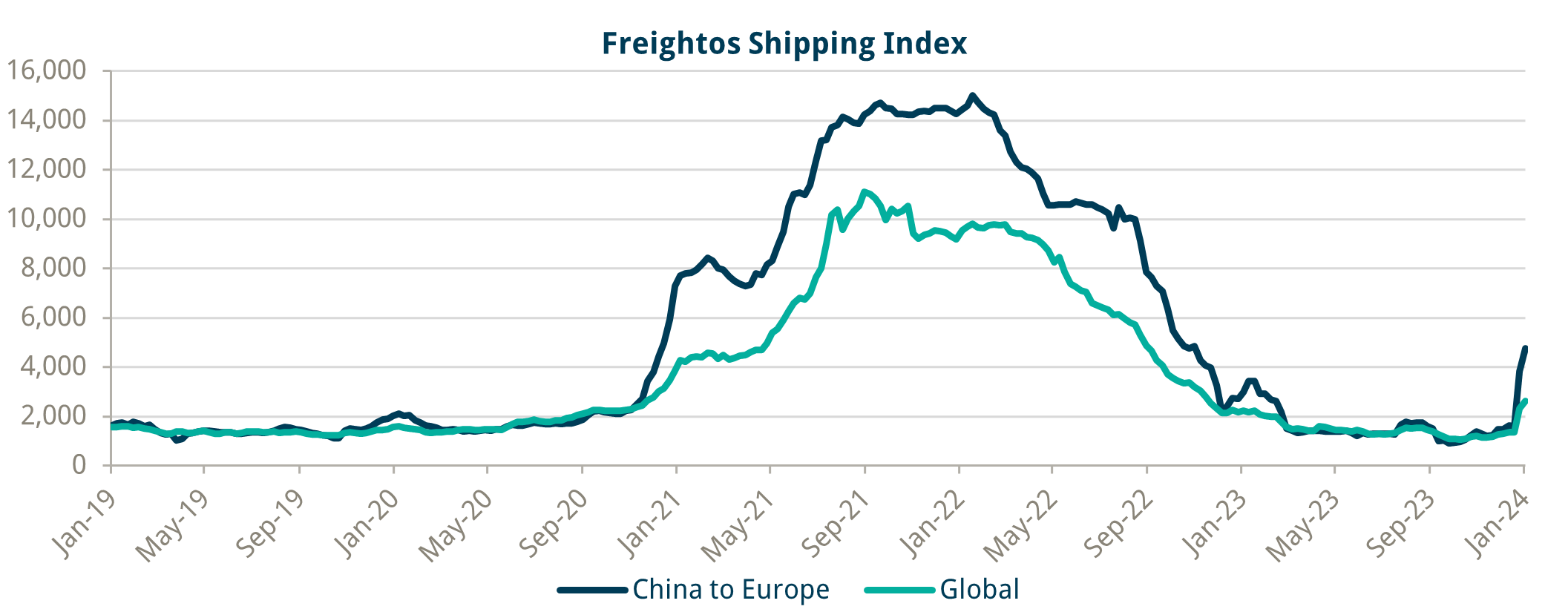

The direct effect of these is likely to be seen in global inflation as shipping costs would simply add to the cost of goods. The chart below shows the magnitude of the recent increase in shipping costs globally as well as from China to Europe specifically: those have risen by 149% and 418% from their respective lows in October 2023 (and by 196% and 91% just this year so far). Studies show that “when freight rates double, inflation picks up by about 0.7%. Most importantly, the effects are quite persistent, peaking after a year and lasting up to 18 months”4. As the effects are lagged and seen after 4 to 7 months, we expect the impact to likely hit in Q2’24. Obviously, the increases so far pale in comparison to what happened during the Covid pandemic, but they could be large enough to put a dent in the immaculate disinflation argument and therefore take away some of the cuts priced in for 2024.

Source: Bloomberg and Trium Capital

The market seems too focused on economic activity data, while we believe it should pay more attention to inflation dynamics. The period of the Great Moderation (mid-1980s to 2007) was all about growth. Inflation was moving in a very tight range, mostly below target, and it rarely figured in central bankers’ decision-making processes. For example, the Fed was firmly in control of the economy through the demand side because the supply side curve rarely shifted, and the economy was operating under a lot of spare capacity (globalisation). It’s only after 2020 that the supply side gets all over the place while the demand side remains more static. Central banks are out of their comfort zone because they cannot control inflation that easily when its main driver is the supply side.

Moving away from the period of Great Moderation, we believe that the volatility of business cycles will also increase. If that happens, then one would expect to see a higher volatility of interest rate cycles as the central banks’ reaction function also changes. We have already seen a glimpse of that with the Fed abandoning forward guidance and becoming really data-dependent. Other central banks have even stopped their hiking cycles, but then resumed hiking again. It is not inconceivable to see the Fed cutting rates this year but having to quickly pivot back to a hawkish stance in 2025, which would be at exactly the wrong time for the US economy when major mortgage and corporate refinancing resets start, but that is also a story for another time.

______________

1 Oil Super Tanker Rates Soar as Asian Shipper Sparks Market Frenzy, Bloomberg January 9, 2024

2 Climate Scenarios | PortWatch (imf.org)

3 See Trumponomics 2.0: What to Expect If Trump Wins the 2024 Election, Bloomberg January 10, 2024

4 Shipping Costs and Inflation, IMF Working Paper March 25, 2022