Over half of the world will vote next year, expect a lot of dispersion and investment opportunities.

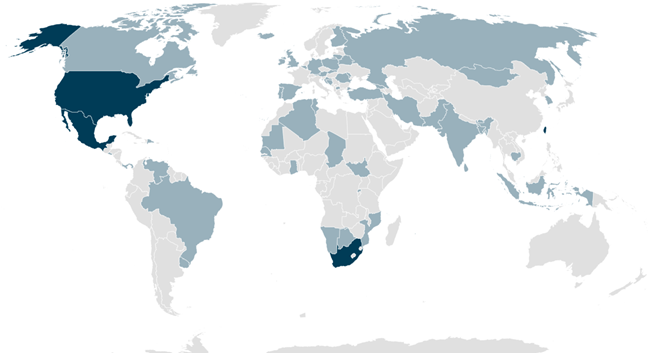

While everyone is focused on the 2024 US Presidential Election, and rightfully so due to Trump still being a leading contender (and political polarisation in the US at quite elevated levels), we are excited for the opportunity set created by the other 60+ countries which have scheduled to hold elections next year. This is a historical moment, with over half of the world’s population being called to vote. But of course, in some of these jurisdictions, the electoral process is not fair nor free, and in a few places, there is almost no possibility of a regime change.

For these “flawed democracies” – countries like South Africa and Mexico, where there is a possibility of change, we expect to see a lot of dispersion and investment opportunities. The fun is not only reserved for EM, however. Besides the European Parliament election, over 20 European nations will also hold elections for both the executive and legislative powers. And to top it all off, the US Election promises to be a blockbuster.

There are four that we are paying particular attention to: Taiwan, Mexico, South Africa and, of course, the United States.

Taiwan

Considering the recent increase in tensions across the Taiwan Strait, the upcoming presidential election in Taiwan is bound to be of paramount significance. However, a supposed coalition agreement by the two main opposition parties, the Taiwan People’s Party (TPP) and Kuomintang (KMT), fell apart just ten days after it was announced. This has reduced the chance of a Beijing-friendly government forming as opposition votes are now likely to be divided.

A win by the ruling Democratic Progressive Party (DPP) may not actually change the status quo, as they have been advocating for an independent Taiwanese identity for a while now. So, in that sense, an opposition win may be the black swan that disrupts current China-Taiwan and China-US relations. In any case, there is no foregone conclusion on the effect of the two possible election outcomes – in each case, we will need to see what the positioning and reaction would be from both China and the US (the latter potentially being delayed by the US presidential elections later in 2024).

Mexico

A historical election will take place in June, which may culminate in Mexico’s first female president. On one side, current President Andres Manuel Lopez Obrador (AMLO) has favoured Claudia Sheinbaum, former Mexico City Mayor, for his seat. He has previously vocalised a divisive rhetoric against his opponents and the electoral authority. She seems to be less confrontational than AMLO and has indicated a more business-friendly and environmentally conscious approach.

Sheinbaum’s presidency, however, is still poised to uphold the policies initiated by López Obrador, albeit with added complexities. The challenge lies in sustaining macroeconomic stability amid altered circumstances, potentially resulting in financial constraints for policies centred around social issues. Despite Sheinbaum’s commitment to energy nationalism, her position on climate change and the limited room for manoeuvre may trigger a reassessment of the sector, possibly leading to negotiations with private companies.

Opposition Candidate Xóchitl Gálvez (current Senator), on the other hand, is anticipated to prioritise macroeconomic stability, acknowledging the hydrocarbons sector’s importance for attracting investments. Gálvez might accentuate regionalisation in the energy sector, empower regulatory agencies with increased autonomy, and advocate for greater private sector involvement in PEMEX and CFE, simultaneously reducing the emphasis on refinery operations.

In our view, government support for PEMEX is anticipated to remain a prominent theme in 2024. This, coupled with the potential for regaining market access, will play a pivotal role in helping the company overcome short-term debt challenges and instilling confidence among investors. We continue to follow PEMEX closely into 2024, even though we are cognisant of market risks.

South Africa

Although small, there is a real possibility that the ruling party, ANC, may fail to gain the majority for the first time in 30 years. Instability in energy supplies has led to recurring power blackouts around the nation. Furthermore, issues in state-owned firms such as Eskom (Electricity Production) and Trasnet (Freight Logistics) have hit the South African economy.

Finance Minister Enoch Godongwan’s Medium-Term Budget Policy Statement at the beginning of November highlighted the shortfall in revenue collection (over $3Bn, or about 5% of GDP), which drove the deficit up, creating many budget dilemmas. Faced with so many unreliable options, the Treasury opted for expenditure cuts, risking major political blowback given the fast-approaching elections. Some international debt holders have even suggested that the country should use its government-owned fold and foreign currency reserves for debt management purposes.

Given the expenditure cuts, actual additional debt issuance will be less than expected, which should be welcomed news for the local bond market. Moreover, the issuance is solely in local markets, with foreign funding remaining unchanged, so external debt should fare relatively better. However, the nature of these cuts (wages and social benefits) may put in doubt their actual implementation as the elections approach, and that will certainly put pressure on bond prices.

United States

It is a bit too early in the process (we do not know for sure who the actual presidential candidates will be). Still, one thing is for certain: the US is going through a level of political polarisation rarely (if ever) seen in the past. This is reflected in recent credit rating agencies’ decisions to downgrade the US outlook, specifically citing deteriorating governance among a plethora of other factors. One of those other factors is the level of public debt, which, as a percentage of GDP, is as high as it was during WW2.

It is this combination of fragile institutional framework and high debt levels – features more common in emerging markets than developed markets – which is a worrying development for investors. When one also looks at the Fed’s bank balance sheet, which is no longer suited to extend emergency assistance in the same way as before, this can become a toxic mix, especially for foreign investors who have been overweight US assets.