Trium Epynt Macro

A Discretionary Global Macro UCITS Fund following a traditional thematic approach focused on monetising major macroeconomic and geopolitical themes.

Share Classes

CONTACT US

Investment Manager:

Trium Capital LLP

Fund Name:

Trium Epynt Macro Fund

SFDR:

Article 6

Inception Date:

30 September 2022

Structure:

UCITS (Ireland)

Base Currency:

USD

Currency Share Classes:

USD, GBP, EUR and CHF

Dealing Frequency:

Daily, 11am Irish Time

Valuation Point:

5PM (US Eastern Time)

0.5 %

10 %

IE000ALF9G18

BJN5134

1,000

0.5 %

10 %

IE000988JJ99

BJN5156

1,000

0.5 %

10 %

IE000I57J1X3

BJN5167

1,000

0.5 %

10 %

IE000BHGRK57

BJN5145

1,000

0.75 %

15 %

IE0005WQI895

BJN5178

1,000,000

1.25 %

15 %

IE000IZ2ZC70

BJN51C3

1,000

1 %

0 %

IE000M8R2ZP8

BJN51T0

20,000,000

Asset classes

Sub classes

Holdings

Aviva

Scottish Widows (Formerly Embark)

Fidelity

MorningStar Wealth

Novia

Nucleus

Transact

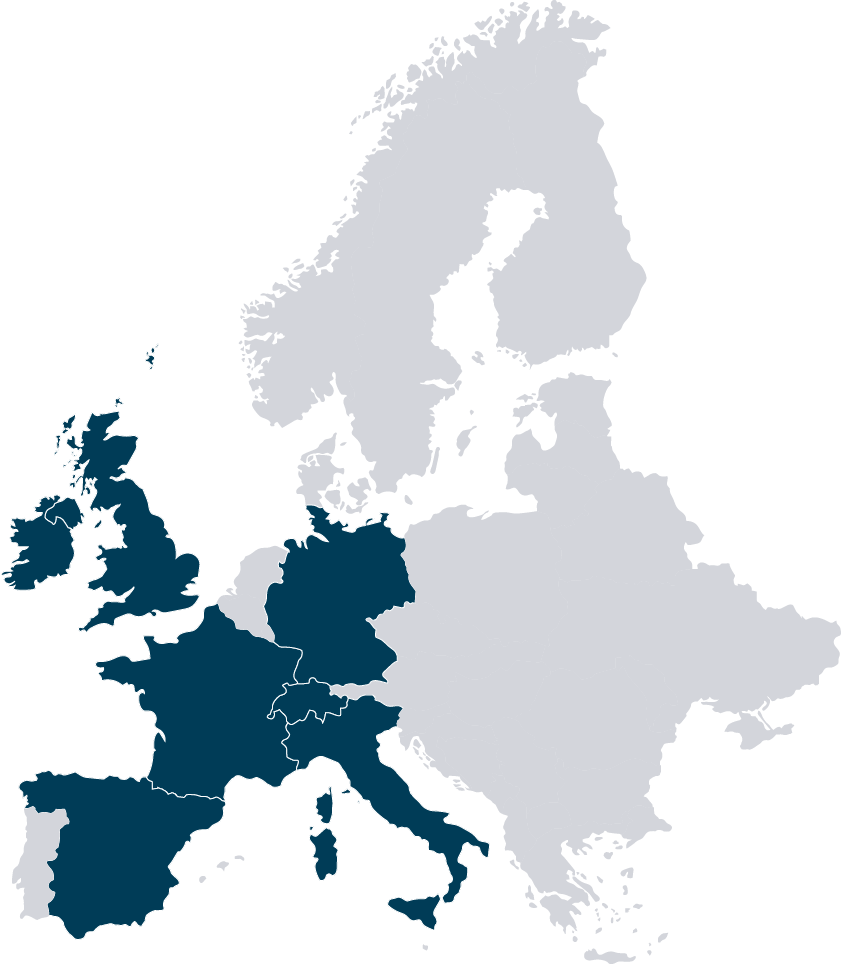

Global availability

France

Germany

Guernsey

Ireland

Italy

Jersey

Spain

Switzerland

United Kingdom