Having gone through multiple episodes of such market turmoil, we can say that even though this experience has a downside, it has helped us develop a general framework on how to think about them (without judgment of how severe they could be). In sum, we should not think too much about the effect of such market upheavals, as we will get lost in the noise – there are simply too many variables: history not repeating itself, changes in the reaction functions, different investor positions, changes in valuations, etc.

Following Occam’s razor principle, we have been looking at the current landscape, attempting to simplify and mute the noise. We get guidance from 1) understanding the current dominant narrative – US exceptionalism, 2) assessing what the consensus is – will it last, and 3) monitoring market participants positioning – most are long USD assets.

US assets – note that this does not necessarily mean the US economy, although one can argue for both – have benefited the most from the current cycle and status quo. Any changes there should lead to a reversal of the recent outperformance. And we think the status quo is changing. Not because we have a magic crystal ball, far from it, but experience tells us that increased volatility, such that we have seen in 2025 so far, at the end of a long cycle typically heralds a change in trend. Furthermore, the market consensus is for a stronger USD and further US asset outperformance. And, thus, market participants are largely long USD and long USD assets.

One will also notice that the current environment is quite different from previous market upheavals, which followed risk-on behaviour. In the past, market participants’ positioning, preceding a risk sell-off episode, was short the USD and long emerging markets currencies. This time, we have had a very unusual, more than a decade-long, risk-taking environment whereby investors have been long the US and short the rest of the world.

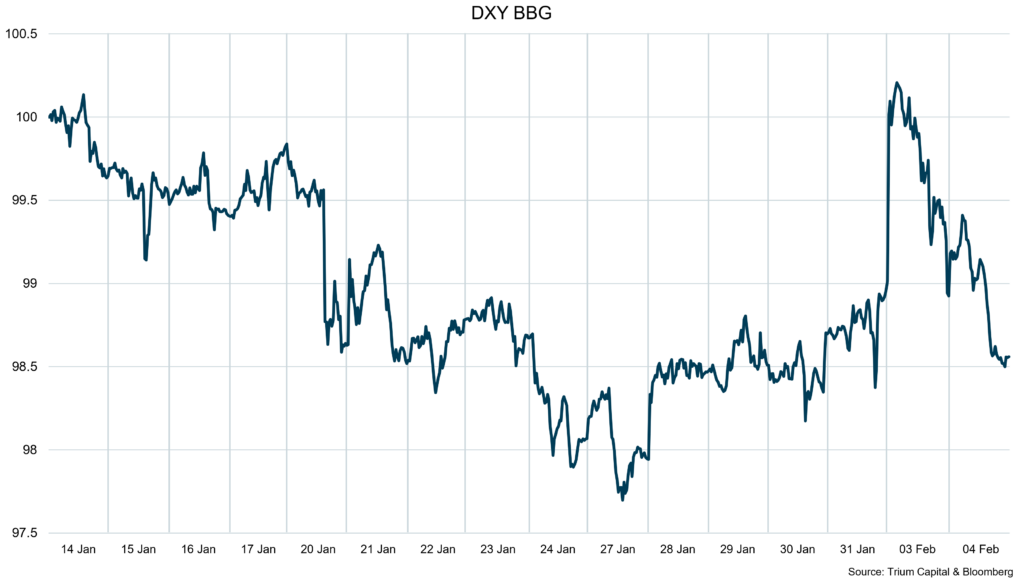

Looking at the USD in particular, the market perception is that compared to 2018-19, there is no tariff premium priced in. However, that is difficult to square with the DXY being not too far from its 2-decade high, or in other words, 20% higher than the low levels seen in the 2018-19 tariff war. In fact, the view on the street is that previous USD strength was driven by the belief in US exceptionalism and, therefore, the USD needs to strengthen even further to reflect the effect of the tariffs. This discourse assumes that: 1) US exceptionalism holds; 2) the rest of the world’s reaction function is the same as in previous episodes.

On the former, US exceptionalism sits on four pillars: loose fiscal, high-tech primacy, cheap energy and a solid institutional framework. All of the above are now being challenged. Historically, Countries have indeed preferred a weaker currency (vs USD) to offset the negative effect of tariffs on their exports, but, again, most non-USD currencies have literally been in free fall against the USD over the last decade, so one can argue there is no justification for them to weaken further as any benefit on their exports will be more than offset by further exacerbating domestic confidence and increasing local capital flight. Therefore, one should not expect these countries’ reaction function to be the same as in the past. For example, given where the Peoples Bank Of China fixed the CNY after the Chinese New Year holidays, China definitely does not welcome a much weaker CNY.

There is also the perception that the USD is still a safe-haven currency. This is questionable, given the current valuation and the US-centred capital flows that have already occurred (see above). Furthermore, if the tariffs reduce trade flows, that will reduce the global USD surplus and, thus, reduce capital inflows in USD assets.

We are aware that the market is not aligned with our views on the USD. We believe that in an extreme risk-off scenario, foreigners will sell USD assets this time and repatriate them back home, which is more likely to weaken the USD. On the other hand, if the tariff threat decreases, depending on the currency pair chosen, a strong USD in a risk-on event is a less likely outcome. We can’t predict which scenario exactly will play out, but from a probability-weighted-risk/reward-Occam’s-razor point of view, we think the status quo is changing, and that will herald weaker USD and USD assets underperforming the rest of the world.