The world of finance is often marked by waves of optimism and enthusiasm, followed by periods of doubt and apprehension. As we find ourselves in the latter part of 2023, a foreboding shadow looms over the global financial markets, casting doubts about the sustainability of the economic recovery and raising the question: is a market crash on the horizon?

The past months bore witness to a disconcerting confluence of events, leaving many investors and experts uneasy. In this article, we’ll explore some of the ominous signs that have raised concerns about an impending market crash.

Bond Market Turmoil: One of the most alarming indicators is the tumultuous state of the bond market. Yields have been on a relentless upward trajectory, and this has caused a ripple effect across various asset classes. While rising yields are often seen as a sign of economic strength, the rapid pace of increase seen in recent months has sparked fears of a bond market bubble. The bond market’s erratic behaviour, despite relatively stable economic data, has set off alarm bells among astute investors.

Inflationary Pressures: Inflation is a perennial concern for the market, and the factors influencing it in 2023 are a mixed bag. On one hand, the resurgent oil market is pushing gasoline prices higher, contributing to inflationary pressures. On the other hand, the US rental market is showing signs of sharp depreciation, acting as a counterbalance. The conflicting forces at play make it difficult to predict the trajectory of inflation, which, if not managed properly, can lead to market turmoil.

Geopolitical Uncertainties: Adding to the mix are geopolitical tensions and global conflicts that have the potential to shake financial markets. The energy market has been responding to supply constraints imposed by Russia and Saudi Arabia. At the same time, the Biden administration’s drawdown of its oil reserves from the Strategic Petroleum Reserve has further tightened the energy market. All of this is happening just as the recent atrocities in the Middle East are threatening to further escalate the conflict to the wider region. The security of global energy markets looks increasingly fragile.

Dollar Liquidity Imbalance: An often overlooked but critical factor is the imbalance in onshore and offshore dollar liquidity. The world conducts its business in dollars, and offshore markets have been starved of dollars as the Fed has tightened. This has resulted in a sharp rally in the dollar’s exchange rates, which is unsustainable in the long run. Foreign central banks, eager to protect their own currencies, have responded by selling off their Treasury holdings, exacerbating offshore financing rates. This feedback loop bears an eerie resemblance to the events that preceded the fall of Credit Suisse and the turmoil in the Gilt market last year.

The Grim Repo

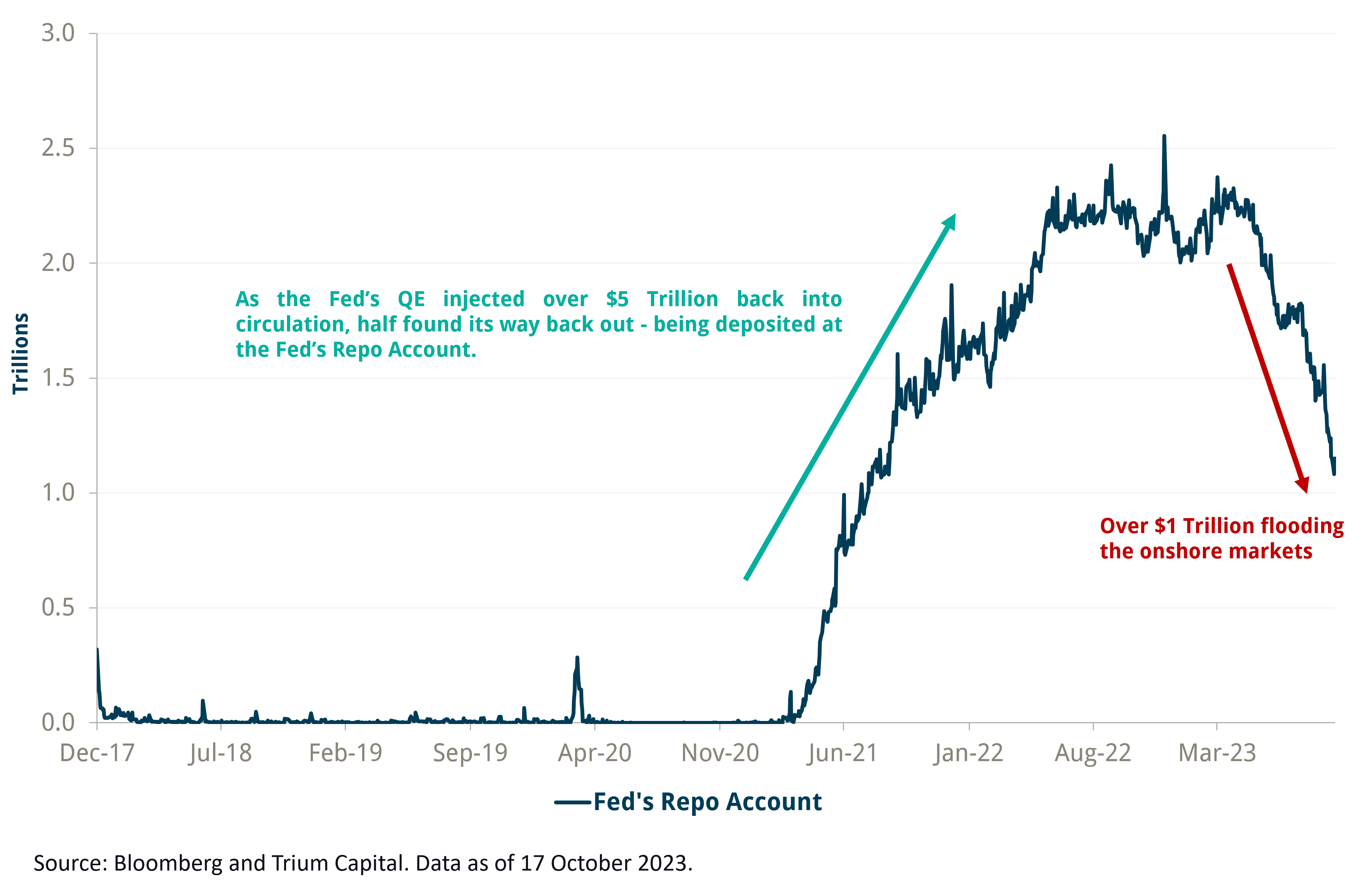

Yet unseen, lurking in the shadows, lies perhaps the greatest harbinger of doom: the Repo account. This account held at the Fed was the ultimate destination of roughly half the Fed’s Quantitative Easing printing (>2 trillion USD). Money-markets participants used it to stash their newly printed cash and earn a measly pickup over the now long-forgotten zero yields. As yields have now risen, this money over the last few months has flooded back into onshore markets and, in the process, supported credit and equity markets. It is perhaps the singular reason why US equities and credit have held up so well as yields shoot the moon. But in a few months, the money will be spent, and the dollar liquidity feast will quickly turn to famine. Risk assets beware.

In conclusion, while the notion of a market crash remains speculative, it is vital to recognise the signs that suggest all may not be well in the financial world. The bond market’s gyrations, inflationary pressures, dollar liquidity imbalances, and geopolitical uncertainties are all factors that warrant close attention. The Repo account, however, represents a clear and present danger. Prudent investors would do well to ensure their portfolios are resilient and diversified, ready to weather any impending storm. While no one can predict the future with absolute certainty, staying informed and prepared is a wise strategy in these uncertain times.