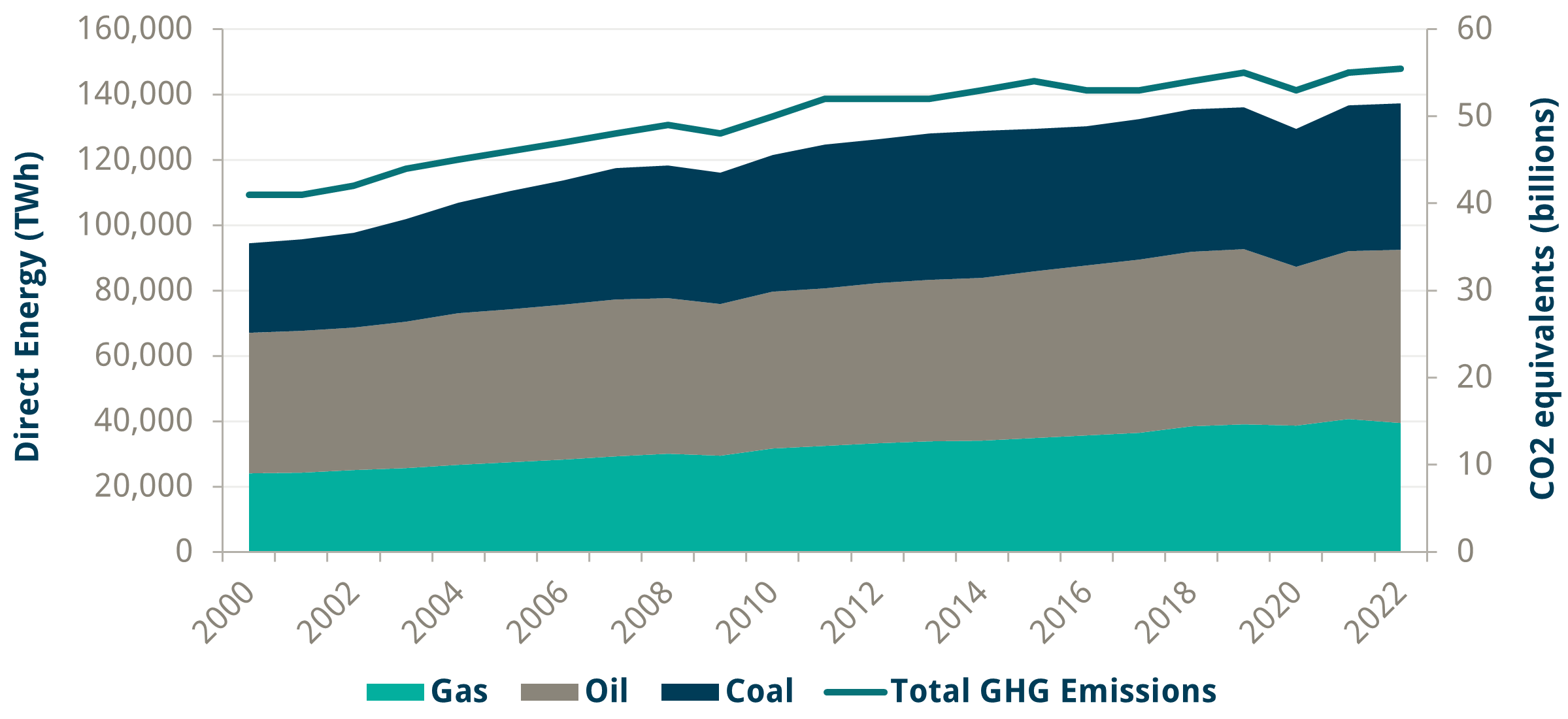

Energy transition and reducing emissions is a global priority, but unfortunately, fossil fuel demand is still growing. The most significant driver of this growth is emerging markets, where GDP growth is still highly correlated with fossil fuel demand. While there are many projections of future emissions reductions, it is important to recognise that current regulations have not reduced global fossil fuel demand or emissions as of today.

Source: IEA

*Total GHG Emissions for 2022 estimated based on 2022 Global CO2 emissions

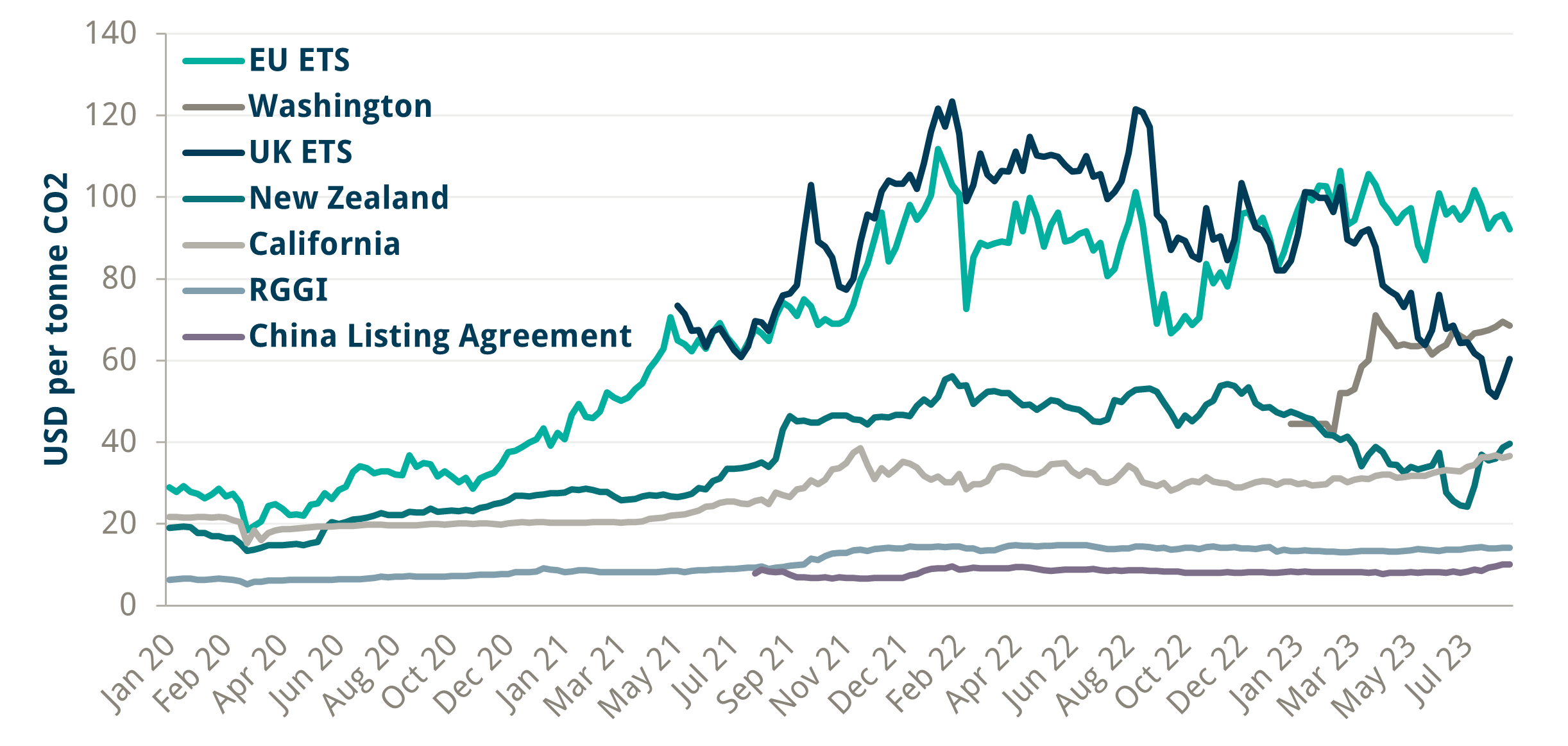

From a regulatory perspective, the most straightforward solution involves attempting to enforce a price on carbon. By establishing a high price for carbon emissions, economics will force reduced demand and substitution and, ultimately, further investment in greener products.

The chart below shows carbon prices around the world. It makes no difference to the planet where carbon is emitted, meaning carbon prices should be the same across the globe, but they are not.

Source: Bloomberg and Trium Capital.

There are two meaningful trends to note:

1. Carbon prices are different everywhere. Carbon prices exhibit even further variation if we consider individual countries. For example, Sweden has country-specific taxes on top of EU taxes, and while other countries have no carbon-related tax at all. As such, we must look at each market separately with regard to regulation and carbon pricing rather than depend on a convergence thesis.

2. Most carbon prices are trending upwards. This appears to be a structural trend as carbon pricing is a ‘quick win’ for regulators. It is much easier for governments to adjust the pricing mechanisms than to fix local permitting issues or improve electricity infrastructure. Carbon pricing also generates revenue that can be redistributed, creating an added benefit for governments.

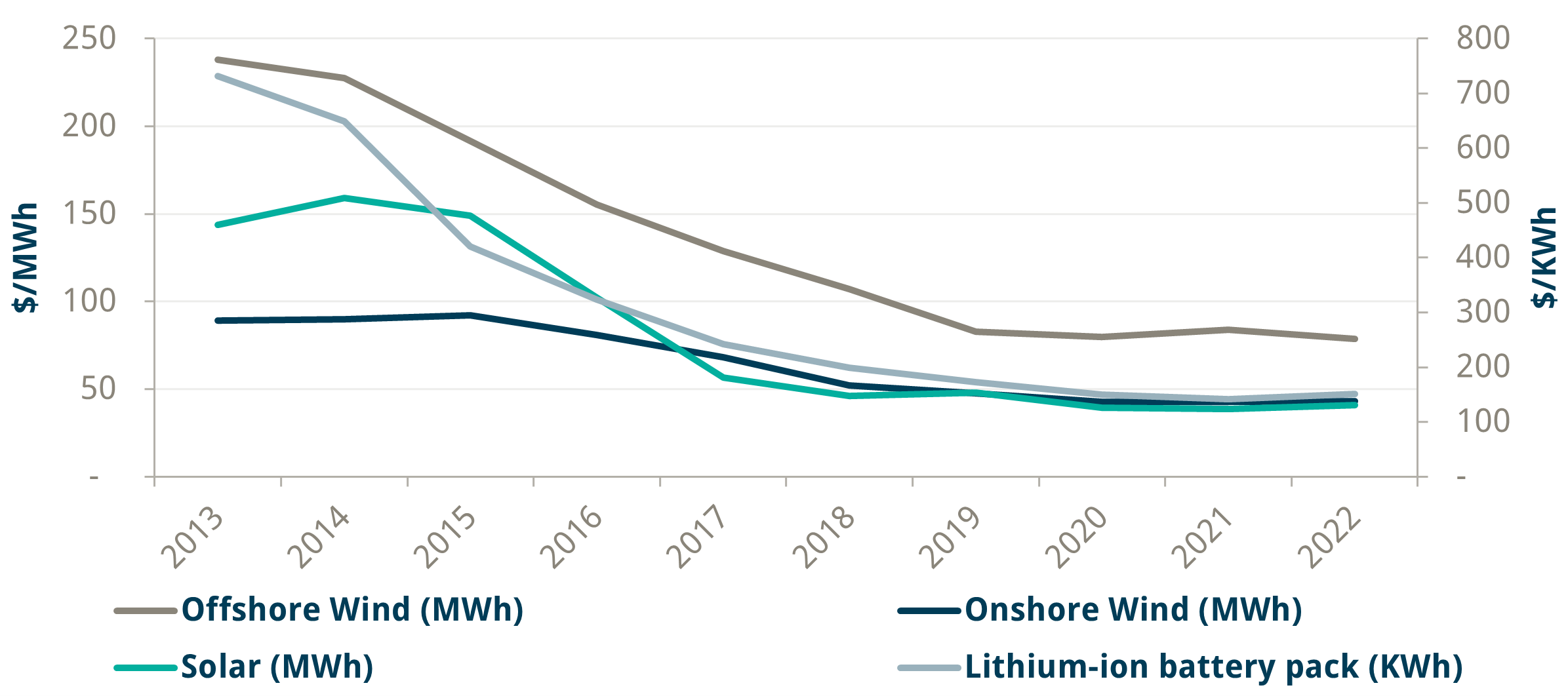

Growth in renewables is central to any global de-carbonisation plan. The chart below shows renewables prices declining over the last decade. Although prices have fallen dramatically for batteries and renewables, the pace has slowed. This should be a sobering chart for regulators, as the cost of wind and some types of solar have risen over the past year due to rising material costs, import tariffs, and rising interest rates.

Source: BloombergNEF

When considered alongside the previous chart on fossil fuel demand, this chart suggests that regulators must get heavily involved if they wish to cut emissions quickly. Although renewables have dropped in price, market forces alone are not going to move capital quickly enough, given the time lags and infrastructure involved.

There are currently many overlapping regulatory efforts focused on decarbonisation. One way to understand the myriad of regulations in Europe is to classify each sector as ETS (sectors where the EU emissions costs apply) or non-ETS (sectors where emissions taxes do not apply). Within the ETS sectors, Buildings, Transportation, and Energy are the three sectors responsible for the most significant emissions outputs. Analysing regulations and trends in these sectors can give insight into how regulatory efforts affect competitive advantage.

The bottom line is that we expect regulation to tighten over time. Initial regulation has been typically focused on defining parameters and collecting data, but it will gradually tighten to achieve goals. Competitive advantage is impacted by regulation through scaling from lobbying, stopping growth capacity, creating import barriers, and forcing product differentiation.

A system loop between economics, voters, and regulatory goals impacts the pace of regulatory tightening. Similar to carbon pricing, we expect wide variations across regions in environmental regulation, as evidenced by the Inflation Reduction Act in the USA and the EU’s limited response. This regulatory divergence can create stock level dispersion in traditionally high-emitting sectors such as Autos, Building Materials, Utilities, Industrials, Aviation, and Shipping.

We recently held a webinar on how regulation will impact stock dispersion in individual sectors. If you are interested in viewing the webinar, please contact ir@trium-capital.com.