The People’s Bank of China (PBoC) continued to loosen monetary policy in August as it attempted to revive the flagging economy. On the other hand, the US continued to defy predictions of doom and gloom while the Dollar strengthened.

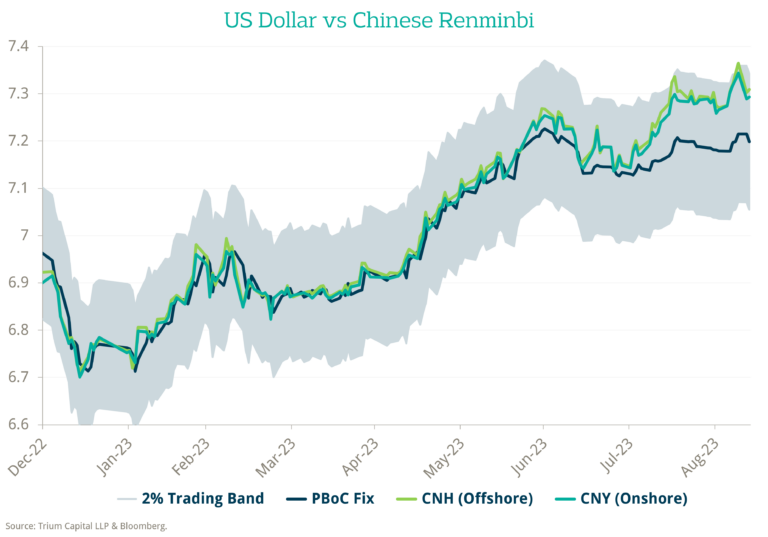

In our view, the Chinese currency is too strong. But rather than doing what needs to be done, the PBOC has sought to avoid drama. The daily FX fixing has been stronger than expected, and state banks have been directed to prop up the currency. The reserve requirement for FX loans was also reduced in August, while Chinese exporters were pushed to convert Dollars back to Renminbi (rather than taking advantage of higher Dollar rates/speculate on appreciation).

China has tried “pulling” its fix (black line) down versus Onshore (teal) and Offshore (green) FX rates, but markets are ignoring the PBOC signal.

The Renminbi continues to weaken – reflecting what really matters: the interest rate differential versus the rest of the world and China’s worrying economic weakness. So long as the US economy remains strong and rates remain high, there is little prospect that China can stand in the way of depreciation using half-baked measures.

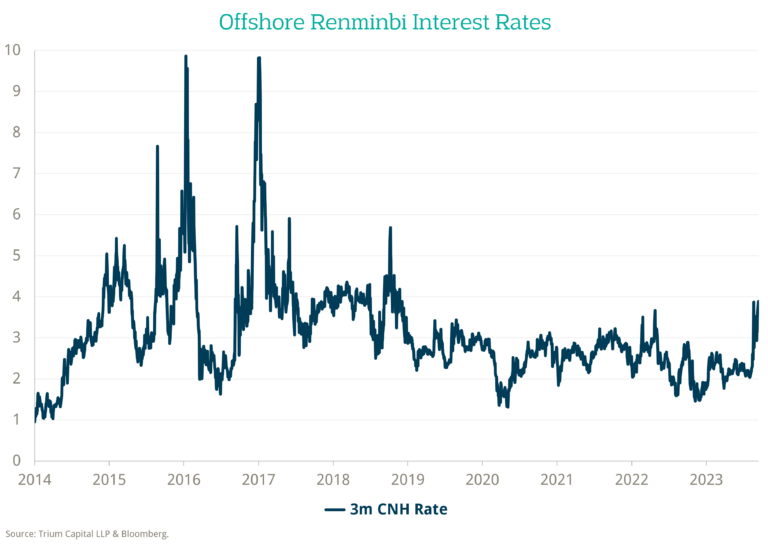

China wants to avoid a messy depreciation of the Renminbi while also cutting domestic interest rates to support a weak economy. It is on a collision course with economic reality. One tool the Chinese are using is to increase the borrowing cost of the Renminbi in the offshore market (CNH) independently of onshore rates – through intervening in the forward FX market. By pushing CNH yields higher, the authorities can allay some of the pressure on the currency (making it less costly for exporters to hedge Dollar profits in the forward market, and more expensive for speculators to go short) while keeping policy easy in the domestic economy.

Opportunities have arisen periodically as sentiment towards China waxes and wanes. Most notably, intervention in the offshore forward FX market was used as a tool by the PBoC from 2014-17 when the Renminbi came under pressure as Chinese exporters were forced to unwind huge and instable dollar borrowing linked to “one-way” wagers on Renminbi appreciation.

Our view is that China will return to selectively targeting the offshore market, causing rates to spike higher.