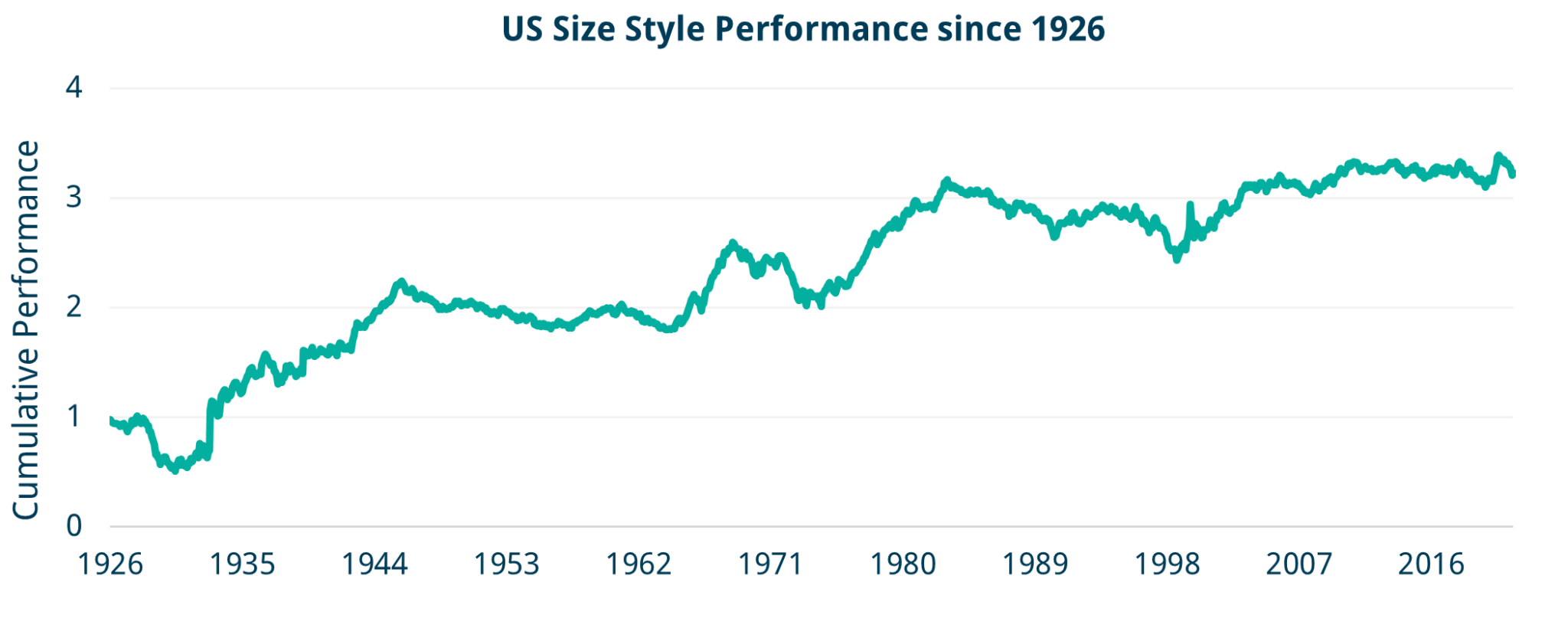

In recent years, many investors have focused on a restricted subset of the investment universe. Acronyms such as FAANG and MAMAA and more recent references to the Magnificent 7 and Sensational 6 have taken headlines and monopolised investors’ attention. This has some merit as we have seen these names substantially outperform smaller peers. However, investing is centuries old, and for some of this history, we have valuable data which illustrates that large-cap outperformance is not the norm. The following chart, for example, displays the relative performance of smaller caps versus large caps in the US since 1926.

Source: Fama – French

Over the long term, smaller caps have typically outperformed large caps due to their better growth prospects. Smaller companies are often quicker to implement new ideas and adapt to changing environments. Additionally, they tend to carry more debt on average and are inherently riskier, which justifies their better performance as a reward for investors willing to accept this risk (positive ‘size risk premia’). Nevertheless, large caps frequently outperform for sustained periods. As mentioned, we have been experiencing such a period recently.

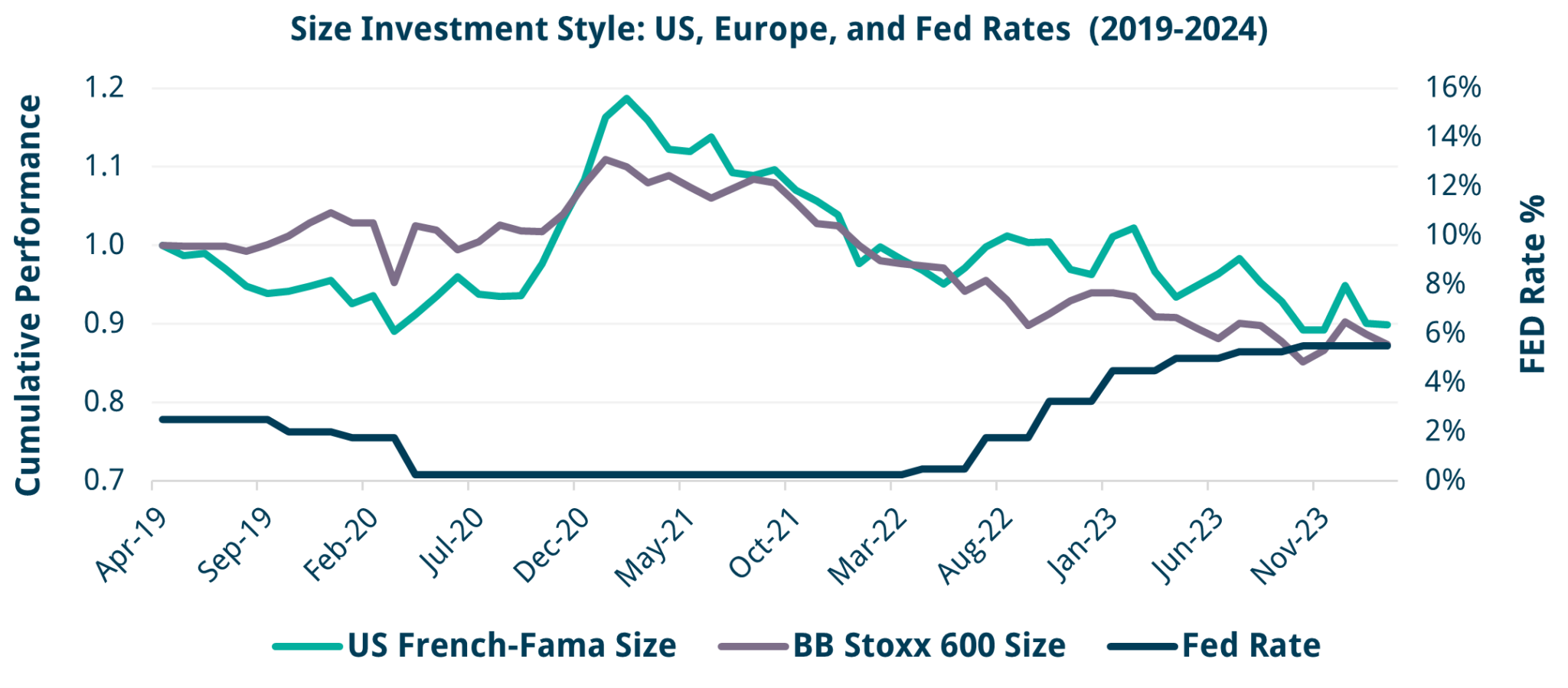

The below chart displays the Size Style in both the US and Europe, along with the Federal Reserve (FED) rate over the last five years.

Source: Fama – French & Bloomberg

We can see the strong cyclicality of the Size Style in the US and Europe (for F-F US Large vs Small, for BB Stoxx 600 Large vs Mid / We converted the Bloomberg Size Factor to be consistent with the traditional F-F approach): Strong performance from the pandemic bottom on March 20 to March 21 and then negative performance since then (negative size risk premia). In sum, we’ve had large-cap dominance in Europe and the US.

The chart also shows the Federal Reserve (FED) rate. Lower rates tend to favour smaller caps, given their higher average debt levels. Conversely, large caps, with lower debt burdens, are more resilient to high interest rates and typically perform better in such environments. As the interest rates increase, large caps tend to outperform and, conversely, as they decrease smaller caps tend to do better.

Currently, investors are looking for a Fed “dovish pivot” to anticipate interest rates falling and act accordingly by tilting to smaller caps. At the time of writing, the market expectation is for one or two cuts by the end of the year. The ECB has recently cut rates, and the BOE is likely to follow, both ahead of the Fed, which is likely to benefit the European small and mid-caps.

What Does This Mean For Systematic Equity Market Neutral Strategies?

A positive Size Style Environment (smaller-caps outperforming) provides more opportunities to benefit from a wider universe of outperforming stocks in line with the Fundamental Law of Active Management. Information Ratio increases with the breadth of independent investment ideas for a given level of skill.

Anecdotally, active managers find it easier to outperform index funds when smaller caps outperform large caps (or when equally weighted index portfolios outperform the indexes themselves).

If the pivot is delayed (“higher for longer”), we expect to see the continued dominance of large caps, Value, Quality, and Momentum styles. However, the alternative regime of the positive Size Style Environment is one Systematic Equity Market Neutral strategies should prefer, given the increased breadth of alpha opportunities it offers.

European vs US Markets

Over the past few years, European and UK shares have notably underperformed compared to the US market. Several factors contribute to this trend, including the energy crisis, the conflict in Ukraine, the absence of prominent technology companies in Europe, and the repercussions of Brexit. In the UK specifically, domestic issues have further dampened investor sentiment, leading to outflows from equities. UK pension funds, for instance, now allocate only around 3% of their assets to UK equities, a stark decrease from approximately 50% in the early 2000s, driven by changes in accounting regulations and maturing liabilities.

From our perspective, the EU and UK markets appear undervalued compared to the US. We anticipate a stabilisation in UK pension fund allocations to equities, as economies and markets adjust to the realities of Brexit and ongoing geopolitical challenges. While Europe may lack significant technology companies, it boasts world-leading sectors such as Healthcare, Luxury, and Defense, offering substantial investment opportunities. Additionally, the anticipation of future interest rate cuts in Europe, ahead of the US, could further bolster the re-rating of European markets against their American counterparts.

Private markets and acquisitive firms have already recognised these opportunities, leading to an uptick in corporate activity. Since the beginning of the year, numerous takeover events have occurred in our investment universe, including Redrow, Virgin Money, DS Smith, Spirent Communications, Direct Line, Covestro, Encavis, Kindred, Anglo American, Darktrace, and Royal Mail. It’s only a matter of time until public markets follow suit, narrowing the valuation gap between the EU/UK and the US.

The convergence of European and UK markets with the US will be advantageous.

Positive Sentiment Around Systematic Factor Strategies

Investors are increasingly recognising the potential for ‘cash plus alpha’ strategies, particularly given the strong performance and rising interest rates. Looking at Systematic Equity Market Neutral strategies, we see that they are beginning to attract capital, evidenced by a notable 8% increase in Assets Under Management (AUM) over the past year, while other strategies have experienced declines, except for a closely related group, Systematic Multi Asset1.

Conclusion

The incoming environment change from Large Cap outperformance to Smaller Cap prominence will create further opportunities. This shift could stem from improvements in the economic environment for smaller caps or from emphatic signals of interest rate reductions.

Furthermore, the convergence of European markets with the US presents promising opportunities. for Managers with exposure to Europe, coupled with a deep understanding of its dynamics, will be well-positioned to navigate these shifts. Alongside the resurgence of favourable sentiment towards systematic factor strategies, we see a landscape ripe with opportunities for continued outperformance.

____________

1 Source: Kepler Report (https://absolutehedge.com/strategies/6-market-neutra);