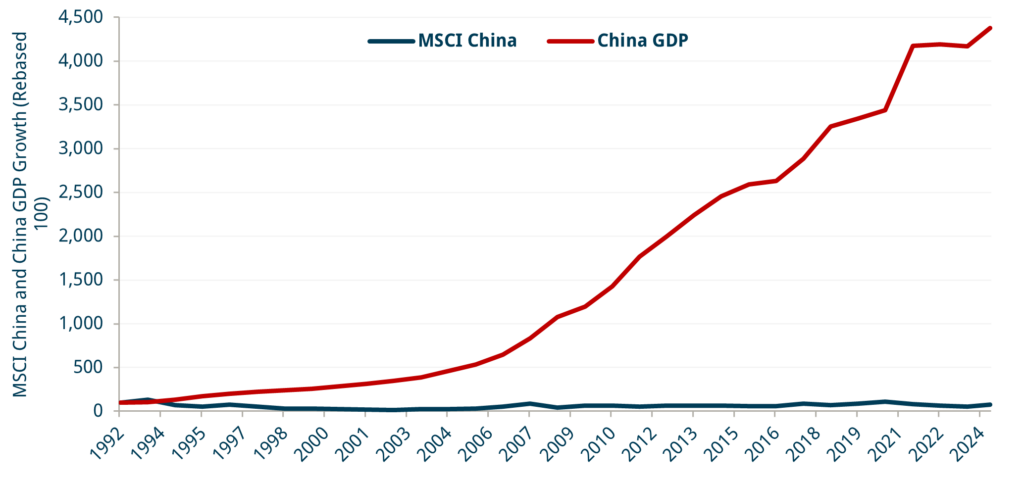

What about the China story in the long run? The main difference between Emerging Markets (EM) and DM is not in the economic hard data (there are plenty of EM with better economic ‘fundamentals’ than many DM) but in the solid intangibles of the institutional framework – the idea being that if EM improves on that front, it can get elevated to a DM status.

For example, in almost any other EM, the anti-corruption policies which China has recently introduced would have been called a ‘reform’ by Western analysts and taken as positive. In China, they were more characterised as a ‘crackdown’ and deemed a negative development. To be fair, the recent regulations in the tech sector have taken the wind out of the drive for entrepreneurship, but only to the extent that it is understood in the West, i.e., the incentive for monetary reward. It remains to be seen whether the collective nature of Chinese society can still generate a level of innovation away from monetary reward as the primary driving force.

In 1982, the SEC in the US introduced Rule 10B-18, which effectively made it very straightforward (and perfectly legal) for US companies to buy back their shares – before that, share buybacks were in the ‘grey zone’, and few CEOs dared to do them for fear of prosecution. That was the beginning of the shareholder primacy movement, which laid the foundations for the greatest bull market in US history. China could be on the cusp of something similar now.

In March this year, CSRC got the ball rolling3, and now we have a more detailed paper4 (in Chinese – thank you, Google Translate!) on how they plan to implement that. As it may be, they called it Regulatory Guidelines of Listed Companies No.10 – Market Value Management. Here is the main point:

Listed companies should firmly establish the awareness of rewarding shareholders and take measures to protect investment by:

- Mergers and acquisitions;

- Equity incentives and employee stock ownership plans;

- Cash dividends;

- Investor relations management;

- Information disclosure;

- Share repurchase;

- Other lawful and compliant methods.

Chinese regulators may have managed to introduce, in one go, all the major shareholder primacy points that the US eventually went through from the early 1980s till the late 1990s. If there is anything an investor wants to take away from all the recent developments in China, it is not necessarily the fiscal stimulus or the interest rate cuts. They are important, of course, but they are cyclical. What one needs to bear in mind is the institutional developments that should make the country very attractive while actually believing in them.

What about Chinese growth going forward? Who cares? China has been growing at 11% on average for the last three decades or so, which has done little to Chinese equities, hasn’t it? Joking aside, structurally, China is unlikely to ever adopt the consumer-centric economic development model, which is prevalent in the West, not because there is some kind of idealistic view against consumption but for security reasons, i.e., Chinese leaders do not want to be dependent on external factors for economic development. This sense of being in balance is partially cultural – from an economic point of view, Chinese authorities want to have 50/50 consumption and ‘production’ driving the economy. But it also stems from how they want society to be organised, i.e. authorities want to have ultimate control.

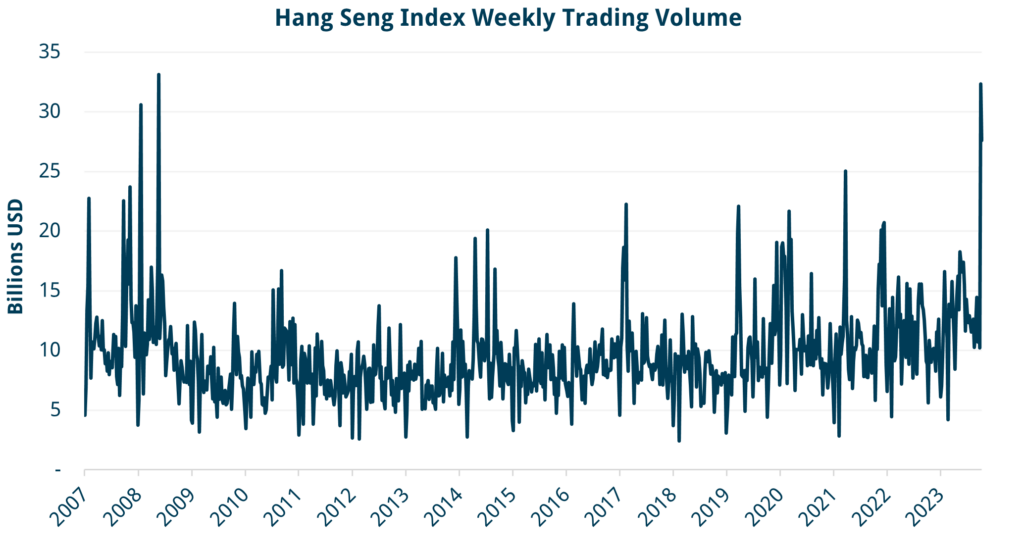

One can also see this in how they have been managing the stock market recently. After an extraordinary rally, the regulator, NDRC, issued a ‘stock market window guidance’ for commercial banks, basically prohibiting credit funds from entering the stock market so as to not create a stock market bubble! Ultimately, this was the main reason stocks collapsed after the Chinese holiday (and not necessarily because they did not give details on the fiscal stimulus – NDRC is the regulator; it is not its job to discuss fiscal policy). To an extent, this could also be the downside of China’s development model: the striving for ultimate control of economic and political outcomes in a world that is, by default, becoming more uncertain as society’s complexity increases.