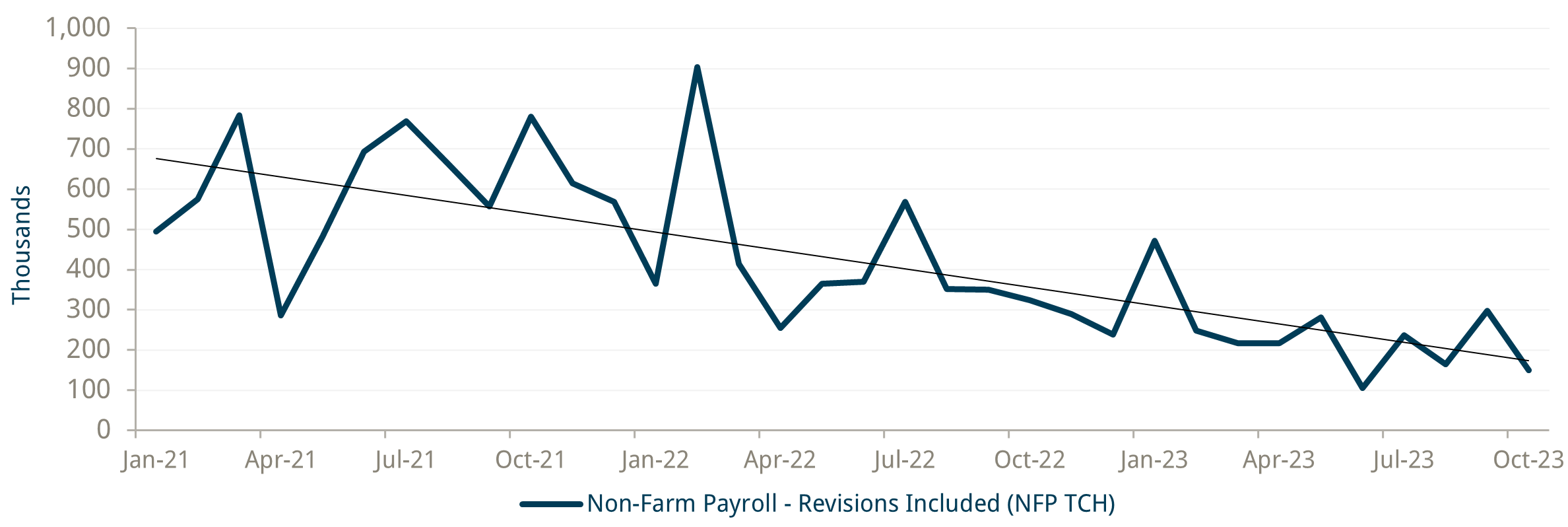

October was a month where headlines were dominated (again) by extreme moves in rates, with the action this time precipitated by a dovish indication that the Fed is officially on hold. Yet somewhat less well covered was a surprisingly poor earnings season for many US large-cap companies, which was strangely combined with a contradictory blowout in US jobs data. The US jobs report no doubt contributed to the rollercoaster in rates, but the increasingly erratic nature of these reports, with revisions sometimes dwarfing the prints, only serves to obscure the underlying real jobs trend. When a deteriorating jobs market combines with a weak earnings season, the sirens of recession always grow louder.

Source: Trium Capital and Bloomberg. Data from 31/01/2021 to 31/10/2023

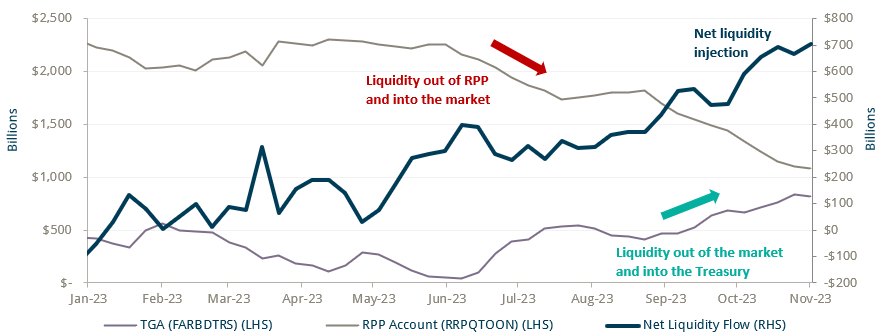

Yet, as with previous months, the most important market data point to watch has been the fast release of fresh liquidity from the Fed’s Reverse Repo (RRP) account back into money markets. Although the money is privately owned, investors are putting it back to work in the system to take advantage of higher money market yields now available. Much of this money, though, has been sterilised by the Treasury issuing T-bills and building up the Government’s Treasury General Account (TGA – a discretionary ‘petty cash’ account used to smooth the mismatch between revenue and expenditure).

Still, October was the first month where the TGA did not build ‘much’, indicating that of the 415bn drain from the RRP, a net 230bn was fresh liquidity added to the onshore system. Given such large sums, it was likely that some of this liquidity found its way to dollar-starved offshore markets, and therefore, it was not a surprise that the dollar took a well-deserved October rest from a robust rally since the summer.

Source: Trium Capital and Bloomberg. Data from 04/01/2023 to 01/11/2023

As we move forward, it must have occurred to Janet Yellen that, by controlling the rate of bill issuance and subsequent TGA build, she can effectively control how much of this RRP private liquidity finds its way into the markets or, alternatively, how much is stashed away for future fiscal expenditure. And there is still $1 trillion left in the RRP account to go: this money’s ultimate destination has enormous implications for both markets and the real economy. Furthermore, Yellen’s dovish market bias, which was always a guarantee as Fed Chair, is, however, not so certain now that Yellen, the ‘politician’, enters an election year. As Treasury Secretary, she has a conundrum: keep markets supported as the real economy continues to slow or build up an election war chest to fiscal pump the real economy (and electorate) in 2024.

Choices, choices…