Uranium has been the standout commodity of the past 12 months – nearly doubling in price to $100 per pound, with nuclear firmly back on the policy agenda as part of the green energy transition.

The elemental surge has drawn the attention of many a punter who might otherwise be engaged in bidding up the shares of struggling video game retailers or taking their chances in high octane tech ETFs. Barely a day goes by without a new FT article on the subject – as the old quip goes, does this mean that it is time to sell?

The bull case: Uranium as a gateway commodity

The endgame solution of pure renewable power and transportation remains a long way off. Battery technology advances are progressing, yet grid-scale solutions are a distant prospect. The hydrogen economy is still a decade away, and we can’t seem to connect wind turbines and solar power quickly enough. We are resource and process constrained and need stopgap solutions while we scale up towards the endgame.

Furthermore, we don’t merely need to replace electric power production with greener sources, we must also expand capacity to meet the increasing demand from electric transportation, housing and industry.

Until we are better able to smooth out the power supply from intermittent wind and solar, nuclear will play a key role in replacing gas and coal as a source of clean (in terms of CO₂ emissions) and stable baseload power as governments strive to deliver on ambitious net zero pledges.

In our previous blog on carbon markets, we explained how widespread political intervention in pursuit of decarbonisation has created a multi-year opportunity for thematic macro investors. We view uranium as another top-down commodity play within the broader decarbonisation theme, having first written about the opportunity in early 2021 when the price was below $30.

As with many investment propositions, the uranium thesis boils down to a supply and demand imbalance that will be difficult and slow to solve.

Demand

Profoundly out of favour in the aftermath of the Fukushima power plant disaster in 2011, demand for uranium is increasing again, with nuclear power having become a rare area of policy agreement across the political spectrum.

Purchases from utility companies will continue to grow significantly. There are currently 436 operational nuclear reactors globally, with 62 new reactors under construction and a massive 118 planned (i.e. expected to be in operation within the next 15 years). China has gone all-in, with 26 reactors under construction and 42 planned. These numbers do not even include factory-built Small Modular Reactors.*

Elsewhere, the US has granted extensions for reactors previously scheduled to go out of service while Japan continues to restart reactors that were shut down following the accident.

Nuclear remains contentious amid concerns around waste disposal but has become more broadly accepted within green circles as a somewhat unavoidable leg in the journey to net zero. At the recent COP28 climate change summit in December 2023, more than 20 international signatories, including the US, France, and the UK, committed to a tripling of nuclear energy capacity globally by 2050.

(Source: Dean Calma / IAEA)

Supply

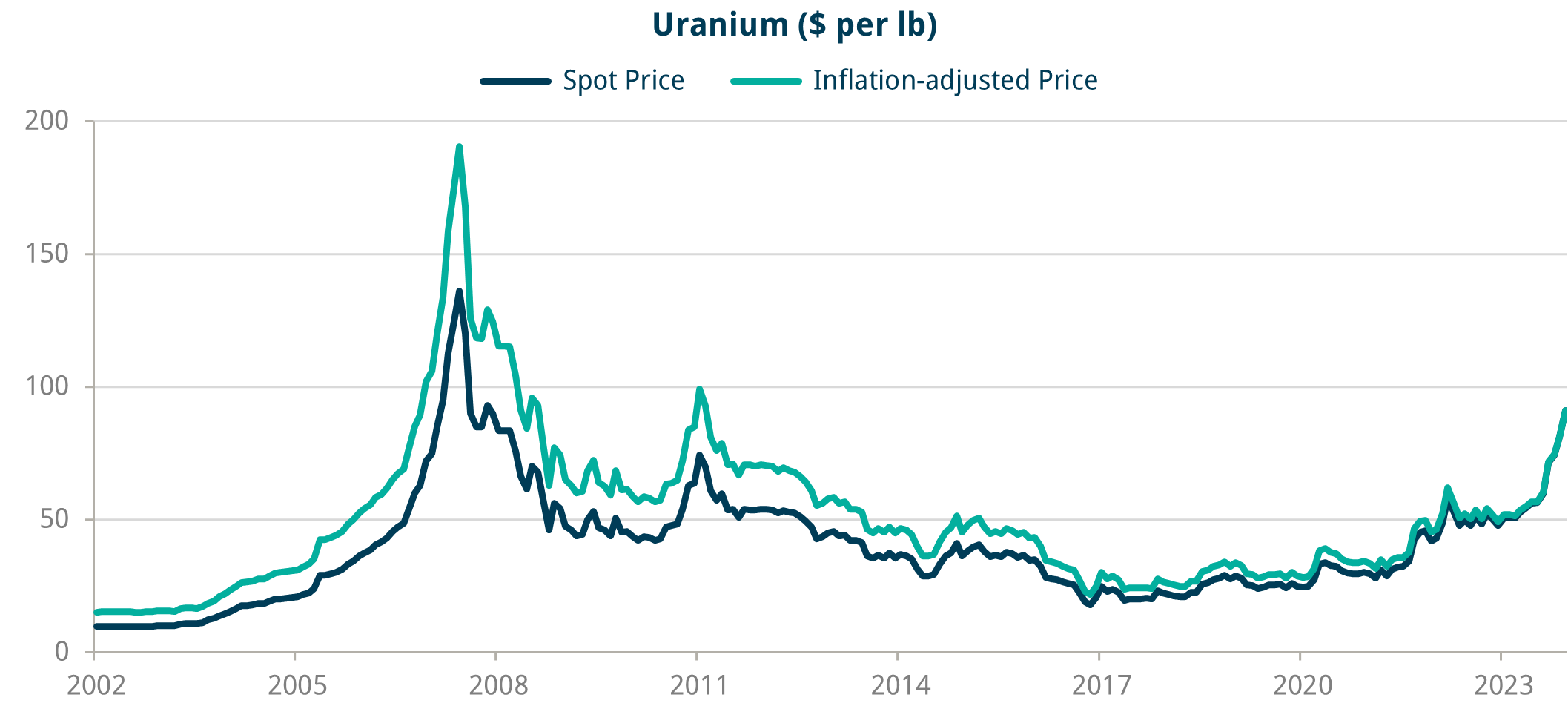

The uranium industry has lacked investment since the last bull market peaked above $130 per pound in 2007, eventually bottoming out at around $17 around ten years later.

While some previously mothballed mines have come back online, many new projects remain stuck in pre-production stages. Even at $100, prices are still below economic levels for some existing and prospective mines, and producers will likely want to milk it some more before deploying fresh capital.

As a result, the uranium market is in a severe supply deficit – with the gap between supply and demand having been met through drawing down inventories built up during the metal’s wilderness years.

The uranium bull thesis is further supported by another powerful macro trend of recent times – deglobalisation – and heightened concerns around energy/national security, which only add to price pressures.

Almost half of the current production comes from Kazakhstan, a former Soviet Socialist Republic, with much of it heading across the eastern border into China. We are now seeing supply chains split into China and ex-China, with the US funding new mines domestically and encouraging uranium-producing allies in Australia and Canada to invest in production outside the hands of the Chinese.

Russia controls a similarly large proportion of the market for the conversion/enrichment of pure “yellowcake” uranium. While the metal was a notable exception from the sanctions imposed in response to the invasion of Ukraine, the US House of Representatives recently passed a bill banning imports of enriched Russian uranium. The bill will now move to the Senate.

Financial participation

The compelling supply/demand equation has not gone unnoticed – with a surge in secondary demand from financial market participants competing with utility buyers.

Vehicles such as the Sprott Physical Uranium Trust (U.UN) hold physical yellowcake, effectively stashing it under the mattress and preventing it from being put to use in electricity production. At over $6bn, Sprott calculates that the trust holds enough uranium to power France’s nuclear energy needs for over two years – not insignificant, given that the French generate over 60% of their electricity from nuclear.

As other inventories have been run down, financial participants are becoming increasingly important players, controlling more and more of the uranium that is needed to plug the supply/demand deficit. They will sell the physical uranium at some point but are not yet incentivised to do so as long as the primary deficit grows.

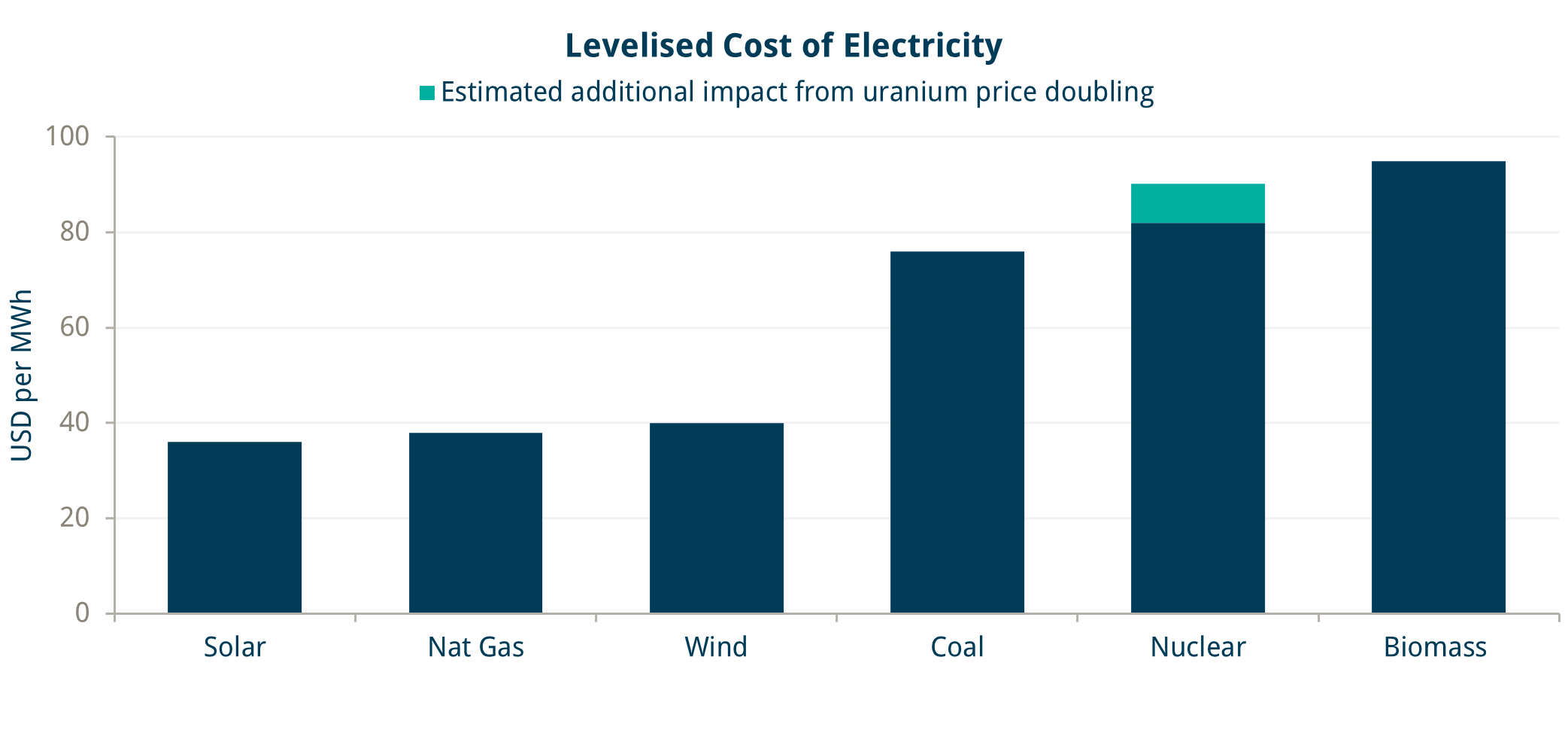

Significantly, demand for uranium isn’t price sensitive. Fuel costs make up only a small percentage of overall costs, so rising prices have a minimal impact on plant profitability compared to gas/coal-fired electricity production (Chart 1). It will take time for supply to arrive, and financial participants will see the potential for a continued squeeze to much higher levels as the deficit widens.

While high levels of financial market participation can sometimes be a red flag for an investment theme, the uranium market has managed to organise itself in a unique way by concentrating exposure in long-term holding vehicles with one share, one vote.

The Sprott trust is akin to a trade union of investors who wish to participate collectively in the long-term uranium theme. While they can sell the trust, the physical uranium remains locked up until all investors jointly agree to release its iron grip on the market. This mechanism prevents cascading selling by weak hands from freeing up physical uranium to end buyers. With growing deficits for years to come, this tight hold on reserves will grow until miners can actually deliver enough new supply to sustain the market.

Chart 1: Impact on electricity production cost from doubling of uranium price

Source: BofA Research Investment Committee & Trium Capital LLP

Note: Some analysts would argue that the cost of nuclear power generation compares much more favourably with both wind and solar production when considered on a more comprehensive “all-in” basis – factoring in associated power storage and grid improvements required to handle production intermittency.

Chart 2: Even after the recent rally, the inflation-adjusted price of uranium is 50% off 2007 highs