Trium Climate Impact

A Discretionary Equity Long/Short Market Neutral UCITS Fund that aims to generate positive environmental outcomes and alpha with reduced exposure to market volatility.

Share Classes

CONTACT US

Investment Manager:

Trium Capital LLP

Fund Name:

Trium Climate Impact Fund

SFDR:

Article 9

Inception Date:

26 October 2022

Structure:

UCITS (Ireland)

Base Currency:

EUR

Currency Share Classes:

USD, EUR, GBP, CHF and SEK

Dealing Frequency:

Daily, 11am Irish Time

Valuation Point:

5PM (US Eastern Time)

0.5 %

10 %

IE000J6OJ9C5

BN487N2

1,000

0.5 %

10 %

IE0003ARWI18

BN487Q5

1,000

0.5 %

10 %

IE000D8ZRYF7

BN487P4

1,000

0.5 %

0 %

IE000DMLF260

BN487L0

1,000

0.5 %

0 %

IE0008F05TO2

BNKC9H6

1,000

0.5 %

0 %

IE000F2976P8

BNKC9K9

1,000

0.7 %

12 %

IE0000B0L1O3

BN487T8

1,000

0.7 %

12 %

IE0009VYGL13

BN487W1

1,000

Asset classes

Sub classes

Holdings

SFDR designation: Article 9

The Fund’s aim is to create a market-neutral and resilient impact fund that can deliver positive impact and protect capital during periods of market volatility. Aligned with these goals, the Fund’s impact objective is for the portfolio to deliver measurable environmental outcomes by targeting portfolio companies that can grow their sustainable sales or improve their Impact Key Performance Indicators (“KPIs”).

We focus on companies with a strong emphasis on climate-focused sales, seeking alignment with both the EU Taxonomy and the United Nations Sustainable Development Goals (“SDGs”).

7IM

Abrdn

Aegon Arc

Aegon Institutional

Aegon UK

AJ Bell

Aviva

Scottish Widows (Formerly Embark)

Fidelity

Fundment

Benchmark Capital (Formerly Fusion Wealth)

Hubwise

M&G Wealth (Formerly Ascentric)

MorningStar Wealth

Novia

Novia Global

Nucleus

Parmenion

Quilter

Raymond James

Seccl

Titan Wealth

Transact

True Potential

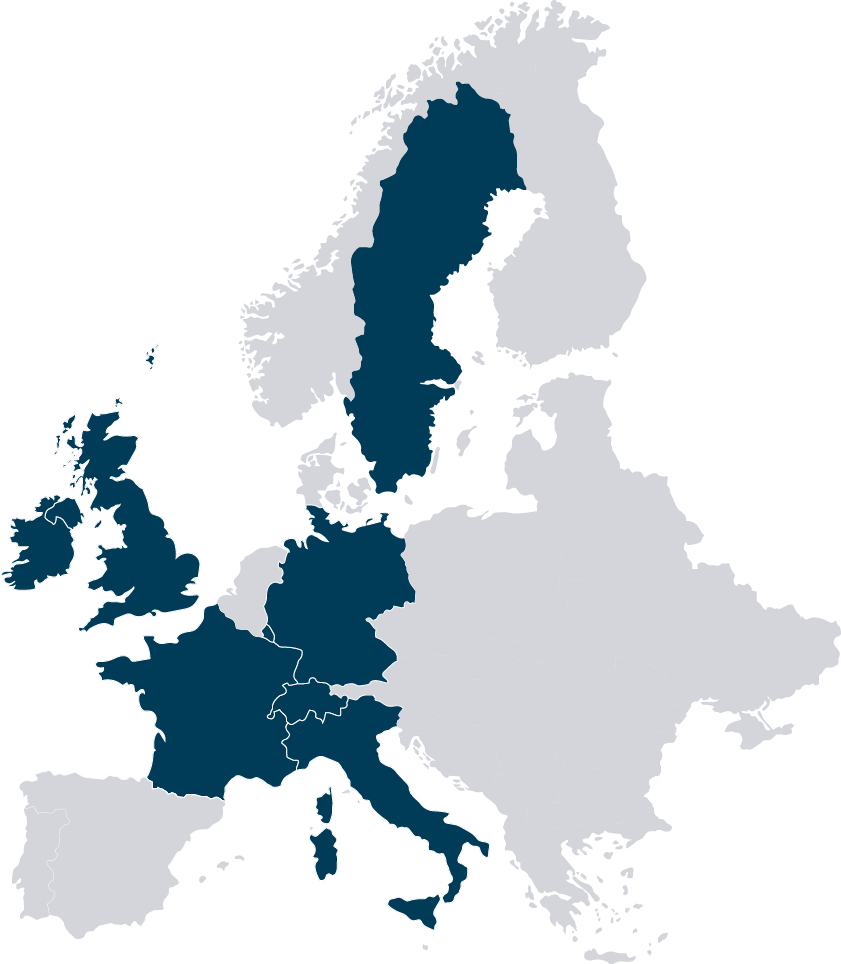

Global availability

France

Germany

Guernsey

Ireland

Italy

Jersey

Luxembourg

Sweden

Switzerland

United Kingdom