Trium Epynt Macro

A Discretionary Global Macro UCITS Fund following a traditional thematic approach focused on monetising major macroeconomic and geopolitical themes.

Share Classes

CONTACT US

Investment Manager:

Trium Capital LLP

Fund Name:

Trium Epynt Macro Fund

SFDR:

Article 6

Inception Date:

30 September 2022

Structure:

UCITS (Ireland)

Base Currency:

USD

Currency Share Classes:

USD, GBP, EUR and CHF

Dealing Frequency:

Daily, 11am Irish Time

Valuation Point:

5PM (US Eastern Time)

0.5 %

10 %

IE000ALF9G18

BJN5134

1,000

0.5 %

10 %

IE000988JJ99

BJN5156

1,000

0.5 %

10 %

IE000I57J1X3

BJN5167

1,000

0.5 %

10 %

IE000BHGRK57

BJN5145

1,000

0.75 %

15 %

IE0005WQI895

BJN5178

1,000,000

1.25 %

15 %

IE000IZ2ZC70

BJN51C3

1,000

1 %

0 %

IE000M8R2ZP8

BJN51T0

20,000,000

Asset classes

Sub classes

Holdings

Aviva

Scottish Widows (Formerly Embark)

Fidelity

MorningStar Wealth

Novia

Nucleus

Transact

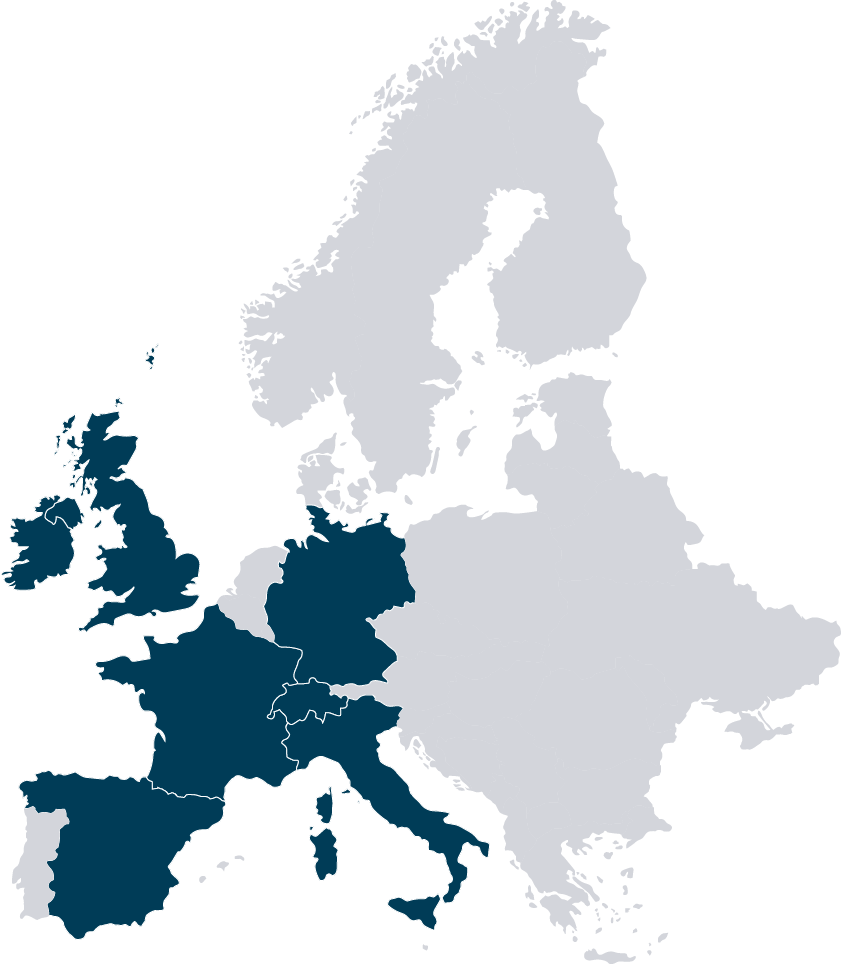

Global availability

France

Germany

Guernsey

Ireland

Italy

Jersey

Switzerland

United Kingdom