As macro investors, we seek to position ourselves at the juxtaposition of policymakers and markets. While the drive for decarbonisation has become increasingly divisive in the UK, the movement has nonetheless secured a broad mandate globally, and we see an opportunity. We regard naysayers of decarbonisation and the ESG investment phenomenon in the same light as those who railed against QE in the post-GFC era: investors should play as best as they can the cards they are dealt. As such, we are generally looking to embrace rather than push back against the opportunities provided by decarbonisation.

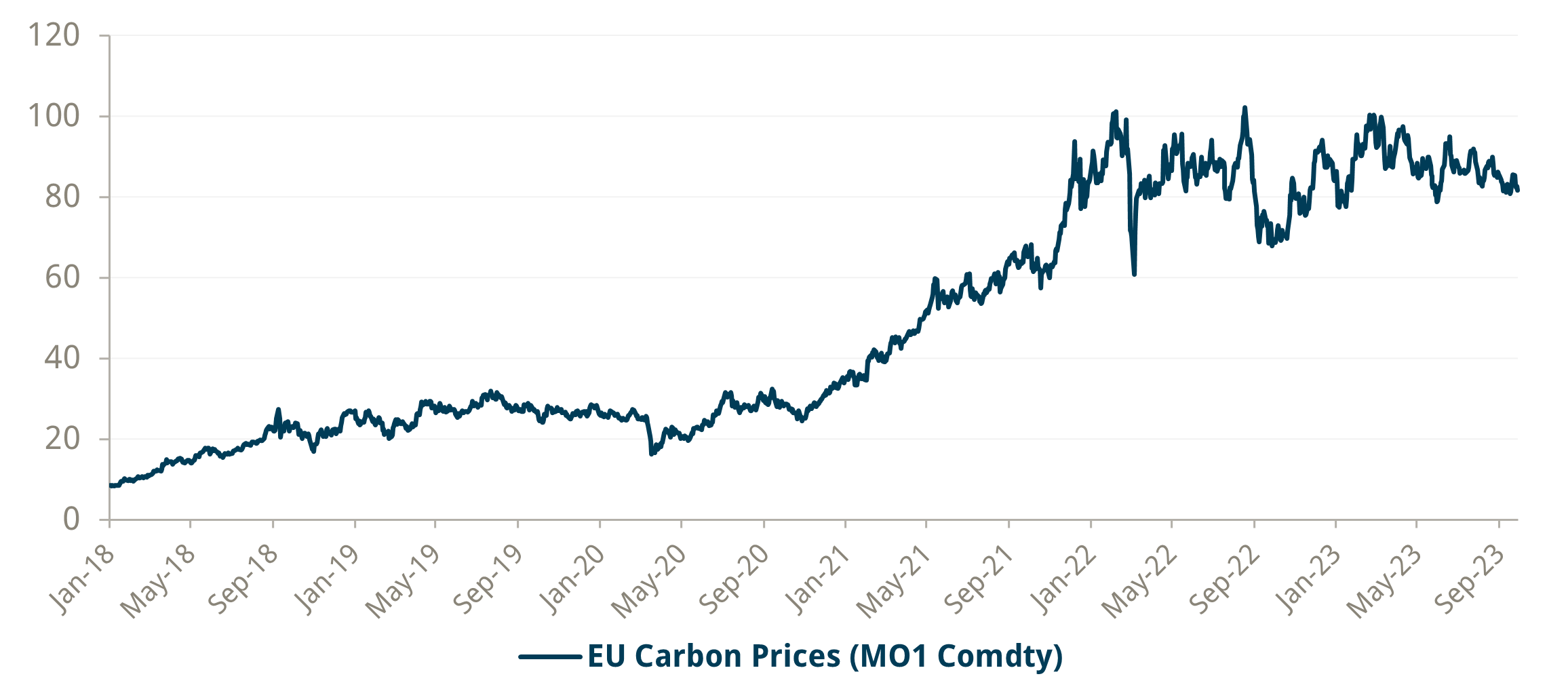

Back in 2019, we identified carbon allowances as the purest play on the theme. Policymakers wanted a higher carbon price to incentivise investment in less carbon-intensive production and kickstart spending on clean technology.

The opportunity boiled down to a supply and demand equation, with the supply of carbon emissions allowances mechanically constrained by the issuers (governments) as they strive to hit their increasingly ambitious emissions reduction targets. Demand could not be abated quickly enough from emitters who picked much of the low-hanging fruit in terms of carbon reduction and struggled to deliver further gains. The best opportunities in macro arise in such scenarios where government intervention collides with free markets.

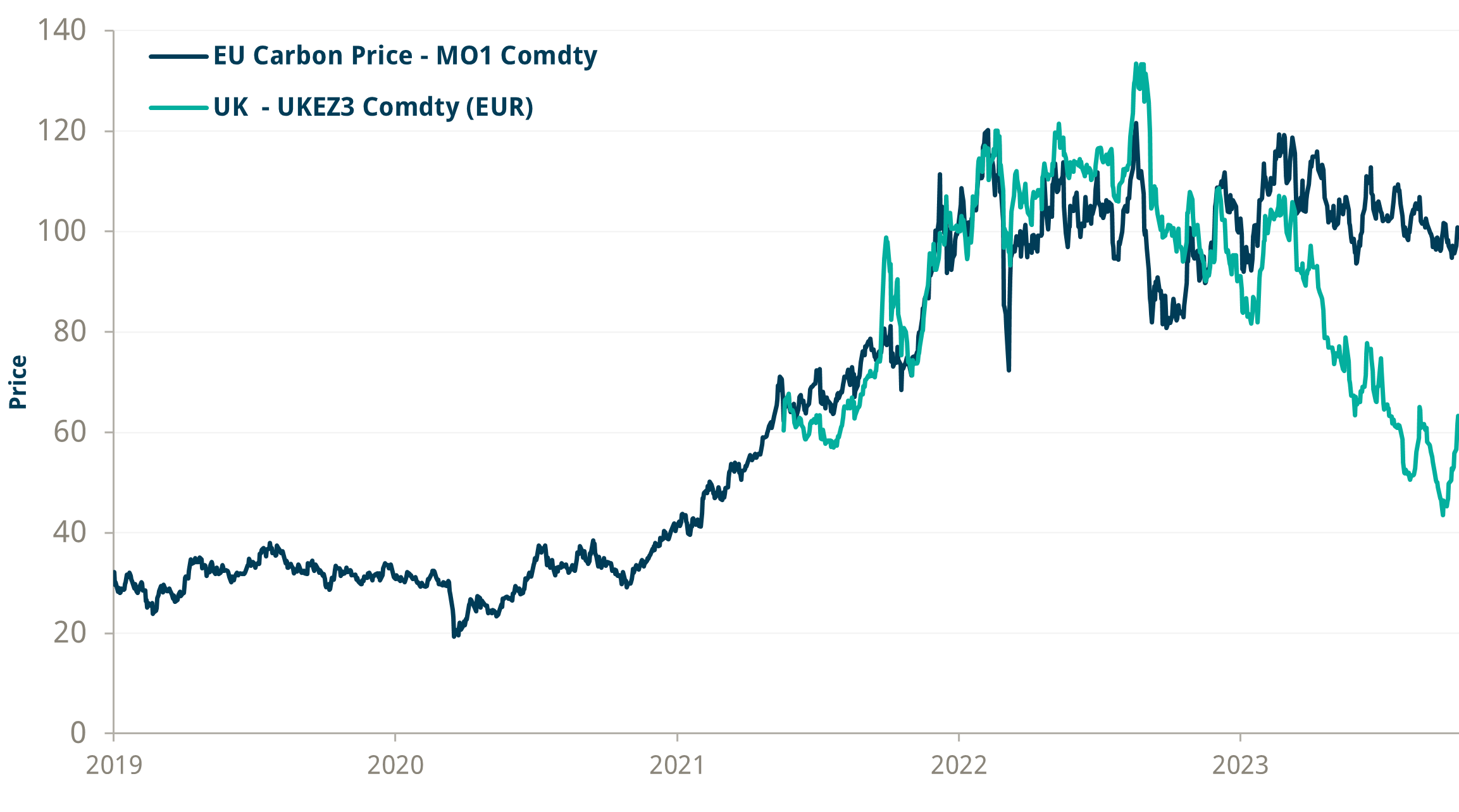

EU carbon allowances rallied from the March 2020 lows of EUR 15 to over EUR 100 per tonne

Source: Bloomberg and Trium Capital. Date as of 30 Sep 2023

What can't go up must come down

Eventually, as technology becomes more mature and efficient, the price of carbon can be expected to decline.

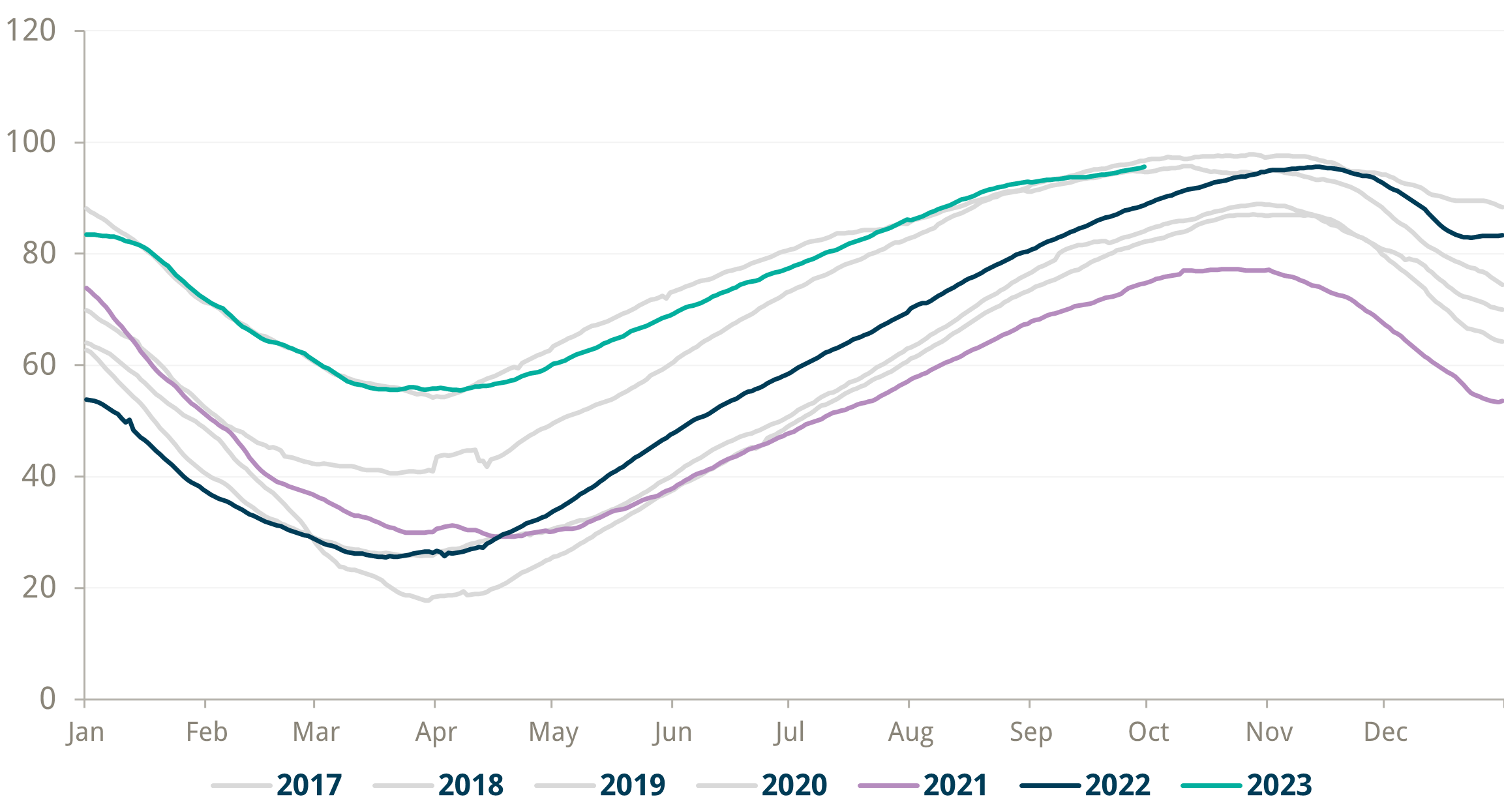

We previously stated that EU carbon would need to trade closer to EUR 150 before this happened, but carbon has failed to break the key EUR 100 level on multiple instances despite a series of very bullish developments. Tighter policy, in the form of the EU ‘Fit for 55’ scheme, has increased the overall ambition of emissions reductions by 2030 to 62% compared to 2005 levels. Meanwhile, Russia’s invasion of Ukraine, while initially having a negative impact on industrial activity (and hence demand for allowances), has resulted in large-scale substitution of gas for higher-emitting but cheaper coal. Yet the price has essentially been flat for the last 18 months, and we now believe that it could be vulnerable to a reversal driven by both supply and demand factors.

Demand

Improved gas and nuclear power availability will result in lower demand for allowances over the next year. European gas storage tanks have filled up fast, even without Russian pipeline exports, as the infrastructure to enable higher LNG imports is paying off. Gas storage is now closer to 2020 levels when EU gas prices collapsed to all-time lows, rather than the supply-constrained environment of 2021 and 2022 when the price spiked. The tanks are already full. Gas deliveries have nowhere to go until the winter draw starts. The risk on gas is two-sided. The price spike risk is always there, but now, so is the risk of a supply glut forcing prices lower. Prices could even go negative as gas arrives with nowhere to put it.

EU gas storage getting full – yearly supply tank % volume filled

Source: Bloomberg and Trium Capital. Date as of 30 Sep 2023.

French nuclear power issues were a major contributor to the gas price spike and extra coal burn in 2022, but with significant maintenance Capex, power output clawed its way back to the five-year average seasonal output. This is the first time that power generation has been close to seasonal expectations for 18 months, despite high water temperatures and low river levels, which in the past have hurt generation.

In the meantime, decarbonisation technology has accelerated, driven by necessity, with no more room for doubt around the vulnerability of Russian supplies. The pace of both wind and solar developments has accelerated alongside increased nuclear power investments.

French nuclear renaissance – seasonal nuclear power output

Source: Bloomberg and Trium Capital. Date as of 30 Sep 2023.

Furthermore, long-range weather forecasts point towards the prospect of another mild winter in Europe, meaning lower carbon demand for heat production. Ironically, as other countries emit more and the globe warms, energy demand in Europe drops, given that the EU, in aggregate, has much more of a problem with the cold rather than warm weather, and the energy demand from heating is ten times the demand from cooling.

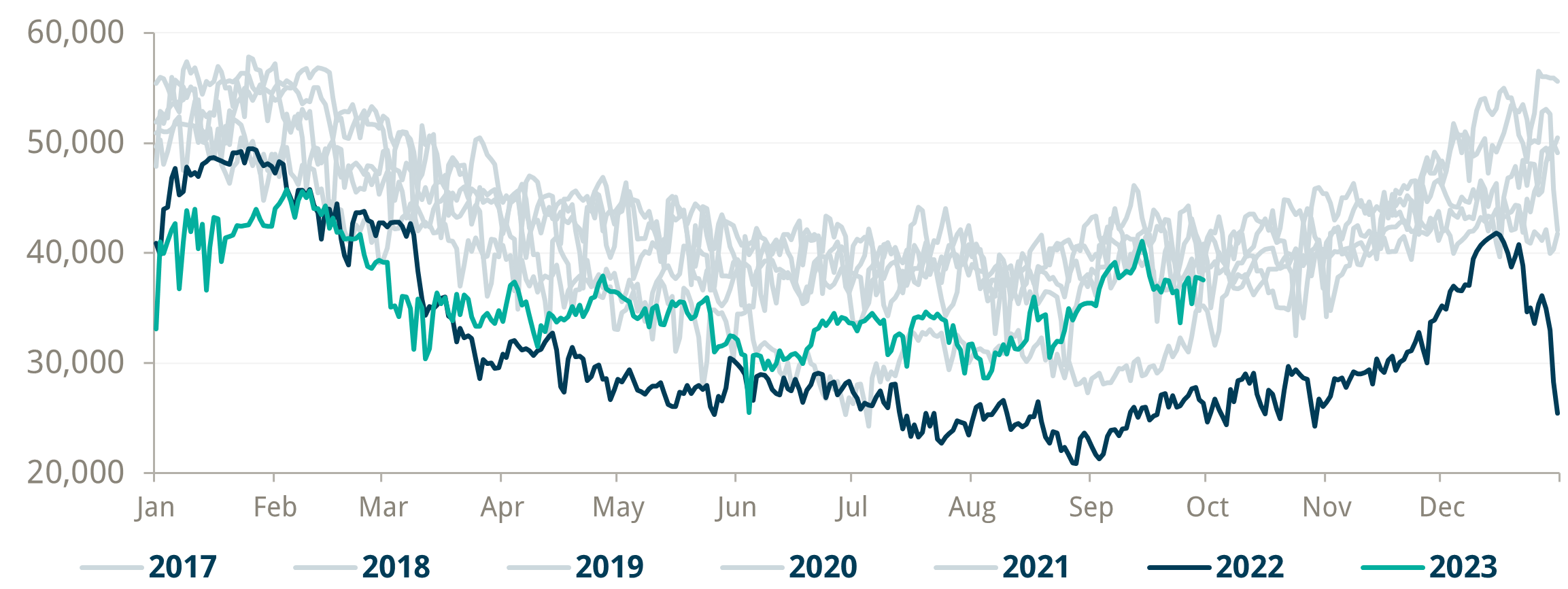

Supply

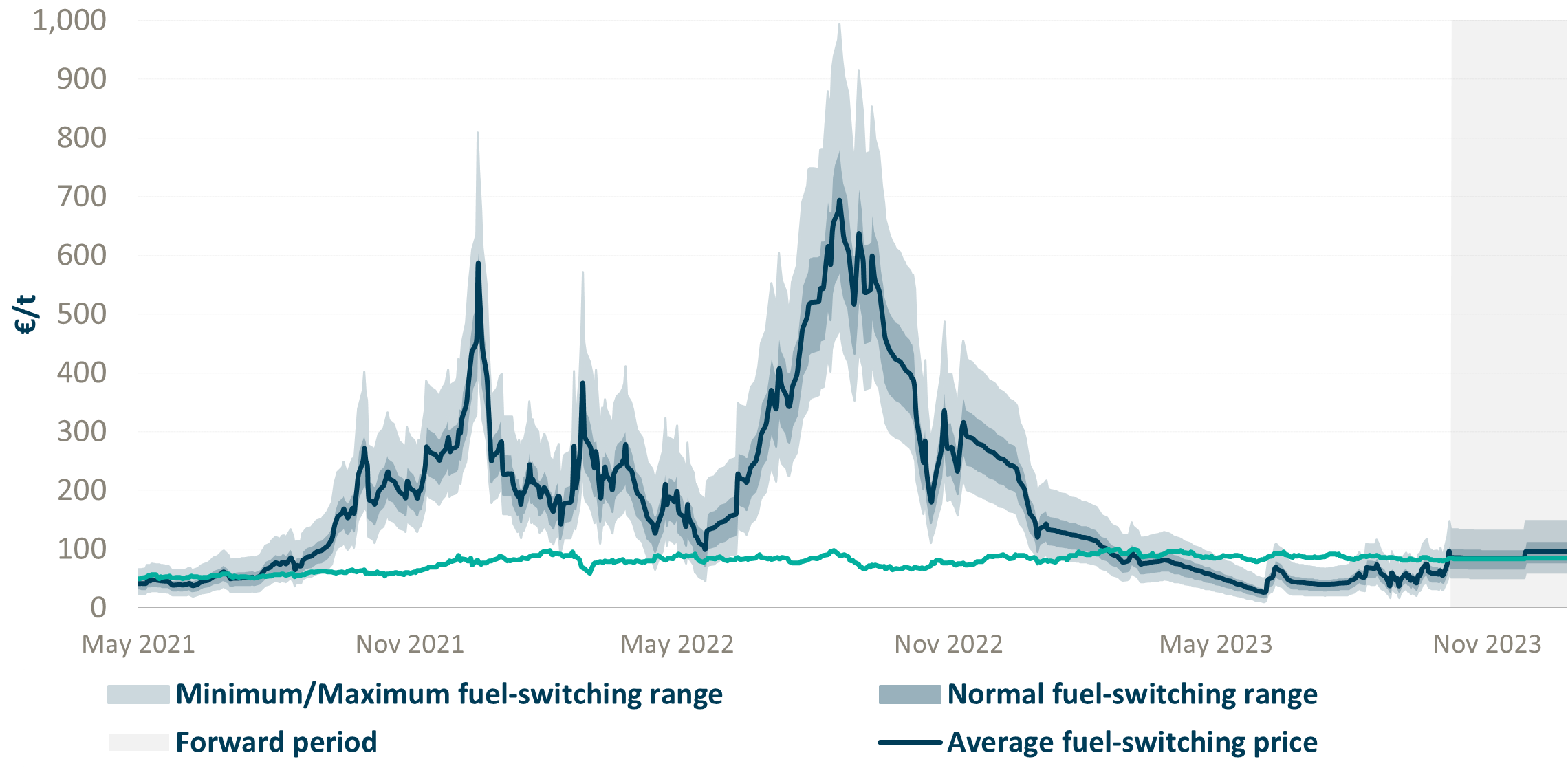

Coal-to-Gas switching has been economical for the first time in two years. While spot switching is economical, it has not been that way long enough to change fuel plans for power generation. For that, you need the forward market to be priced to lock in the economics for a sustained period. Power operators geared up for a higher long-term coal burn in 2022 by increasing purchases of coal futures, and emissions allowances to account for the doubling of emissions per MW of power that comes from burning coal over gas. Once operators can get long-term visibility of cheaper gas, then they will unwind their hedges and dump significant excess carbon allowances on the market.

Coal to gas switching pays for first time in 18 months

Source: Bloomberg and Trium Capital. Date as of 30 Sep 2023.

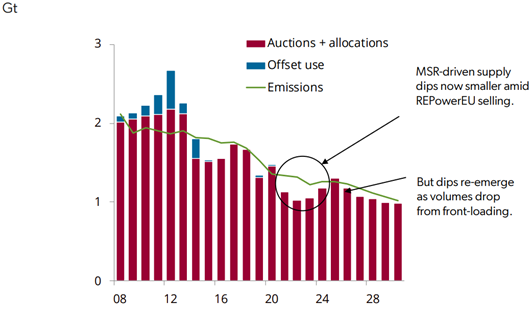

The supply of allowances will be frontloaded over the next couple of years as the EU uses the carbon market to fund its REPowerEU scheme (a cash cow whereby allowances are sold to finance other projects – e.g. energy bill support). This means that the number of allowances the market needs to absorb is actually increasing in the short term. This is occurring just as the supply/demand balance slackens as the Market Stability Reserve (EU’s mechanism to address the surplus of emission allowances that built-up post-GFC) supply reductions come to an end.

We are now coming out the other side of three years of significant deficit between the supply and demand of emissions allowances. The next couple of years look very different – in 2024, the supply deficit will be marginal, and in 2025, there will be a surplus of credits. Significantly, this forecast is based on an expectation of a continued shortage of gas/high electricity prices. If we see plentiful power next year due to any of many factors (recession/lower industrial production, Russia/Ukraine ceasefire, higher LNG deliveries, increased renewables output) then we could see a glut of emission credits materialise sooner rather than later.

Energy Aspects EU ETS market balance – emissions demand expected to flatline in 2024 (green line) versus increased supply

Source: “EU A| June 2023 Report” – EEA, Energy Aspect

Outlook

The “Fit for 55” legislation is aggressive, but it is well understood and likely priced-in. The chance of another significant legislative ramp-up is low. We believe that a price drop to EUR 60 would likely be met with relief rather than consternation, and a more significant fall would be required to provoke any change to the system – especially if the goal of decarbonisation is seen as being achieved at lower-than-expected price levels.

The price of carbon has remained flat on the back of the most bullish possible news. As the flow of positive news stories declines and supply increases, we believe that there is a high chance of a self-sustaining price collapse. The combination of these supply and demand factors, plus a lack of price appreciation, could see a speculative investor exodus from EU carbon credits. The UK has a strong, legally mandated, carbon neutrality goal and has nonetheless seen significant price declines in its carbon scheme. This goes to show that aspiration alone doesn’t mean that carbon prices will remain elevated.

Precedent from other schemes – UK carbon (green) has collapsed while EU prices (blue) stay high