It’s officially over. After six months of campaigning and election surprises, Javier Milei has been elected in a surprising run-off. The President-Elect, a self-proclaimed anarcho-capitalist, has been an outspoken critic of public spending, export taxes, and regulations, vowing to privatise many state-owned enterprises. However, his lack of political support from the other government branches, combined with Argentina’s deep economic wounds, will make it difficult for him to deliver on his agenda.

We have been keeping a close eye on Argentina throughout the year, with interest in both credit and equities. We have followed local politics and how the electoral cycle could unfold. Whilst we see potential short term opportunities caused by temporary asymmetries, we believe that the uncertainty makes it difficult to justify long-term positioning. We believe that Argentina is untradeable on a long-term basis.

The degree of macroeconomic distortions and the limited visibility make it extremely hard. If a Milei administration nails a stabilisation plan and gets the market to support a staggering fiscal consolidation plan, Argentina could be the 2024 EM trade, but it’s not that easy. The consensus is that the muddle-through macro narrative just does not cut it, and we may have a credit event sooner rather than later.

We work with what we have, and even if we try to look through the fog, the short-term is still extremely important as it may set the tone for the beginning of a Milei administration. Markets may respond positively to good news flow, but we will continue to adjust our exposure, keeping risk/reward as our main guiding principle.

Political & Economic Transition

There are many things to consider. The main question here is what happens to the currency (remember that Argentine Peso, or “Argy” for short, has a peg on the USD at 355, while parallel markets trade around 900). Will the Central Bank be willing to have a more flexible policy? What will happen to the People’s Bank of China (PBOC) swap lines (increased by $6.5Bn on the 18th of October) intended to pay the IMF maturities and finance imports?

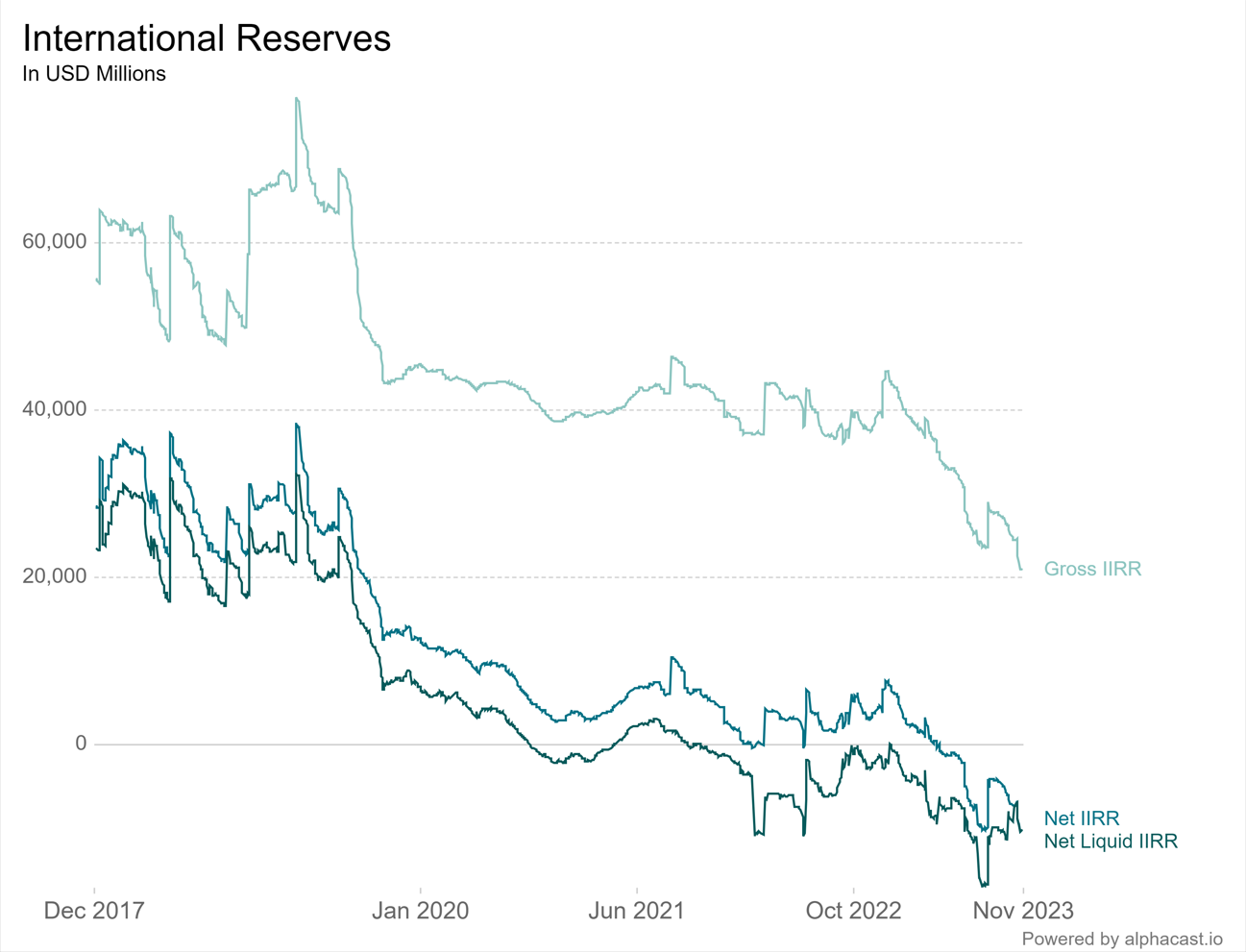

More importantly, and perhaps the enormous, ugly elephant in the room, is the Central Bank’s balance sheet. On one hand, the Central Bank’s FX reserves are negative $10Bn (Chart 1). It’s crucial that the Central Bank does not lose any more reserves, as it could trigger financial stress in local markets. On the other hand, remunerated liabilities (CB issues bills at 133% to local banks to keep monetary aggregates stable) have potential explosive dynamics, which entails significant execution risk by Milei’s administration. As a reference, the stock of these (LELIQs) CB bills creates a new monetary base every three and a half months (Chart 2).

Chart 1

Source: Alphacast.io & Trium Capital

Chart 2 – Months required for CB bills (LELIQs) stock to create a new monetary base?

Source: Alphacast.io & Trium Capital

Dollarisation?

It’s difficult to see how an imminent dollarisation of Argentina’s economy would play out. The Central Bank has no reserves, capital markets are closed to issuance targeted for this, and Emilio Ocampo’s plan (Milei’s Central Bank Chief) needs north of $30Bn to buy back CB bills and Peso deposits. Milei and Ocampo have been toning down on this rhetoric, but market participants have been on the edge of their seats lately. The canary in the coal mine here are banks (their balance sheet is stuffed with CB Bills) and local currency debt (dollarising involves swapping ARS debt into USD debt). Both banks and local debt are hanging in there. If we see banks outperforming (GGAL, BMA, etc.), we can assume that the market is getting more comfortable with a “watered-down” version of dollarisation.

So far, we’ve been seeing positive momentum on this front. Milei has made it pretty clear that this is a crucial “Step 1” for any stabilisation plan. First, he needs to address the CB balance sheet issue. Then, his administration can focus on capital controls, de-peg the USD and, if possible, dollarise.

Political Capital

Milei will need Congress’s support to push through his highly ambitious reform agenda. La Libertad Avanza and Propuesta Republicana (PRO) parties (former President Macri’s and former Minister of Security Bullrich’s respective parties) will likely have over 30% of the seats in the lower house and 20% in the Senate. Milei will also face a consolidated Peronist opposition in Congress. We have seen Milei inviting members of the more moderate Peronist parties to join his administration as well as getting further support from Juntos por el Cambio, which is seen as a positive.

Also, Milei’s choice for Economy Minister is crucial, as a stabilisation plan will not only need political capital but also credibility. Anchoring inflation expectations is vital to aligning expectations and correcting relative prices in an economy that’s upside down. In the very short term, this is the first catalyst. Market participants want to see names – it’s not amateur hour.

Where do we stand?

Short-term, there is upside both in credit and equities. In our view, equities (mainly utilities and oil & gas names) could outperform bonds as we move towards the start of a Milei administration. These companies are unlevered and will benefit from reforms and deregulation from the next administration. Regarding bonds, the default risk embedded in the curve is substantial. While we don’t necessarily argue against that pricing, we think there is some convexity in the trade, in case a Milei administration can surprise the market positively.

Risk has been transferred from offshore into local holders in both credit and equities. Light positioning and a nimble approach are key, given that the market has been burned time and time again – and not only on these recent events. Milei has been pretty vocal in the last few days on respecting contracts, paying debts and engaging proactively with the IMF. We believe that in the short term, he has the incentives to be market-friendly and signal a willingness to work with creditors on getting this ship ashore somehow.