In 1923, a then-little-known economist, John Maynard Keynes, was analysing the commodity futures markets when he stumbled on a peculiar feature of futures pricing. He noticed that the costs of commodity storage, which are often very high, were baked into the contracts’ pricing. He observed that speculators invested in commodity futures would not only receive the commodity return but would also be paid the storage costs on top. Little did Keynes know, but he had stumbled on the first structural return, a return source embedded within a traditional asset class independent of the macro risks that drive the market.

Structural returns are not new, but before we dive into the hows and whys, it is worth framing some constructs of portfolio management. Even Keynes did not quite understand the importance of what he had discovered, and it took some 85 years before the concept of structural returns would become embedded in the financial lexicon. For most of Keynes’ life, all the returns on one’s portfolio were considered to be alpha, or more specifically, stock selection skills. No one had formally described that maybe stock prices ebb and flow with the market until Markovitz, in the 1960s, formalised the concept that a portfolio’s return was mainly due to the market return (beta) and only partly stock selection skill. And it was not until the 1970s that two academics, Fama and French, identified that the market return could be decomposed into styles, such as Growth or Value stocks, which can have very different return profiles.

While style investing is now ubiquitous across the equity world, it is only relatively recently that the same styles found embedded within the equity market are also prevalent in bonds, commodities, and FX. Last but not least, during the previous ten years, it has become apparent that there is a small component of one’s portfolio return that is neither market-driven, style-driven, nor a function of selection skill. This is now what we know to be a structural return.

Structural returns are unique and quite idiosyncratic, making them hard to define as a homogenous group, but you know one when you see one. Their defining characteristic is that their return profile is independent of the traditional risk factors (Fed policy, macroeconomics, pandemic response, earnings, etc.) and, instead, is driven by often quite esoteric factors (i.e. weather, taxation policy, regulation, seasonality, index rebalancing, congestion, credit rating slippage), – factors that are specific and unique to the market in question.

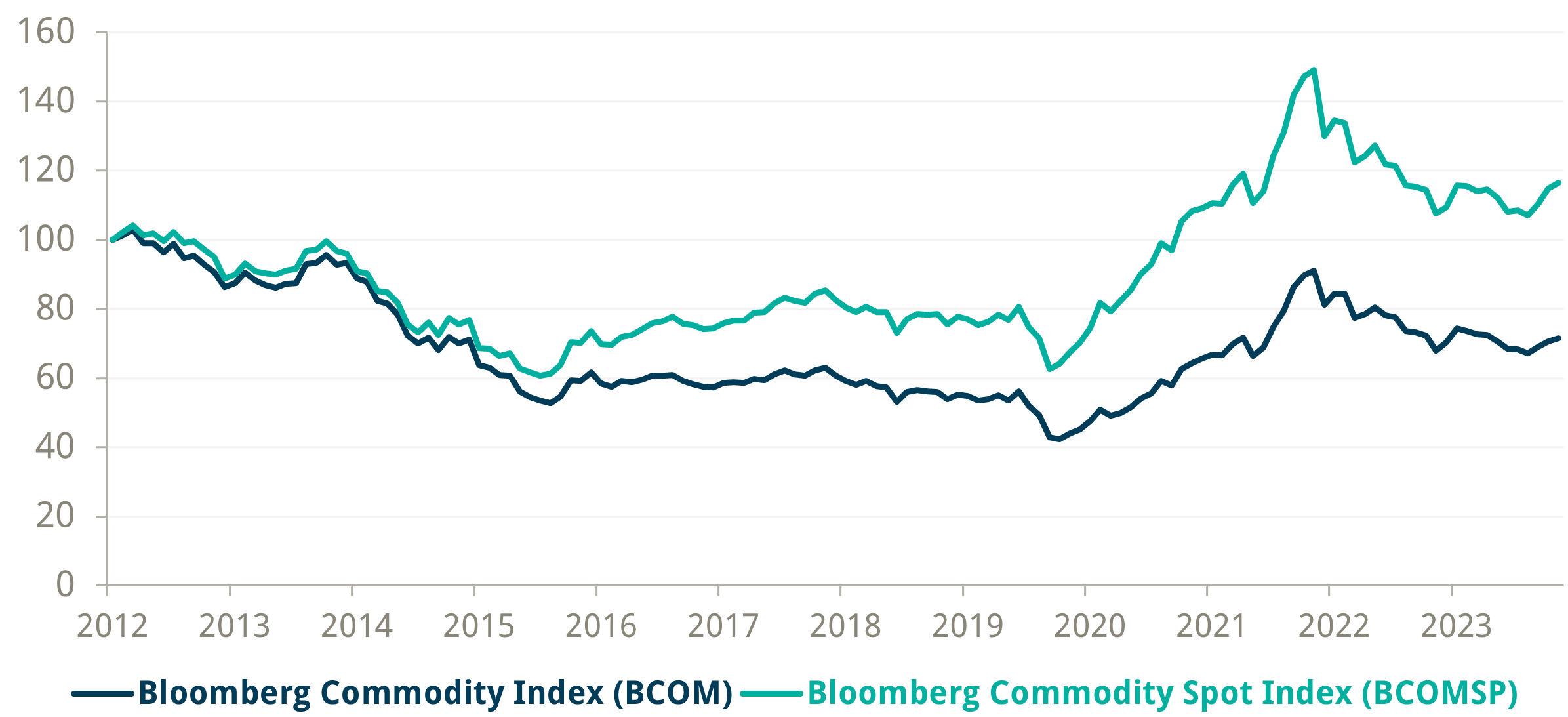

To illustrate, let’s go back to commodities and consider a variant of the Keynes conundrum. The chart below shows a Commodity ETF tracker versus the physical commodity price index. It’s pretty evident that something other than fees is dragging the ETF down versus the physical commodity market. As it happens, two structural returns are working (in this case) against the passive ETF holder. One of these is the ‘congestion effect‘, a structural phenomenon now ubiquitous across any market that has been affected by the rise of passive investors.

Source: Bloomberg

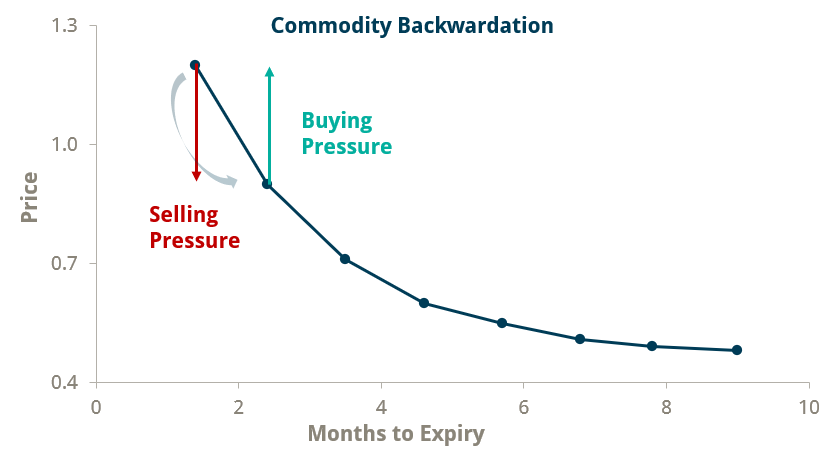

To see how passive investors have created this congestion effect, let’s dig into the mechanics of this commodity example. As Keynes surmised, storing commodities is costly, so investors (either passive or active) typically invest via the futures market. However, as futures contracts expire with time, all investors must roll their position periodically to maintain said exposure. Every month, massive amounts of passive money buys the nearest futures contract, holds the position for a month, and then sells just before it expires to buy the next contract on the curve. This ‘rolling’ on the commodity curve maintains the investors’ constant exposure (beta) to the commodity market. The problem comes from the fact that all passive money has to follow the same index tracking rules (aka roll schedule), and as such, on the same day every month, over $150bn dollars tries to squeeze in and out of the same contracts simultaneously. This wall of money causes price distortions, which every passive investor has to swallow (as they are price takers/price insensitive), leading to structural underperformance of the ETF tracker versus the commodity market.

Source: Based on Dummy Data. For illustrative purposes only.

It is at this point that the Congestion investor comes in. Index roll schedules are published well in advance, and it is easy to see that by selling the front contract and buying the next contract a few days before the index money invests, one can profit from the price squeeze. What is effectively a congestion fee to the passive investor becomes a very persistent return stream for the Congestion investor who prepositions for index flows. However, it does not stop in commodities. Congestion and similar crowding effects are everywhere where passive money goes. While it is easy to see how equity and FX index rebalancing would also be exposed to identical price distortions, one can look further out and see that these distortions extend beyond the influence of just the passive investor.

Indeed, in any market where large non-price-sensitive investors operate, structural anomalies arise and can be monetised. For instance, the most recent example is that of the frenetic online retail investors desperate to trade the latest tech stock (FAANG, MAMAAM, Magnificent 7 or any “meme” stock). Their herding behaviour has created predictable and monetisable rebalancing flows from levered tech ETFs, desperate to keep up with speculative flows on the way up and down. While such distortions clearly make little fundamental sense, the Congestion investor is agnostic and indifferent to market views, seeking only to profit from the anomaly while avoiding the market risk.

While a picture has been painted on the sources of Congestion returns, what are their risks? Congestion strategies monetise market anomalies without taking market risk. As such, the principal risk to the congestion investor is that the anomalies dissipate, leaving only residual crumbs. Fortunately, forecasting when and where a structural return may come or go is unnecessary. The structural investor seeks only to identify the return and proactively move through different return sources as they come and go. While the trade is not risk-free, the risks are particular to each market and unrelated. If, for example, an unexpected rule change happened for commodity index rebalancing at the same time as equity indices, it would be a coincidence, not a correlation. Likewise, traditional economic risks do not play into it and herein lies the most important aspect of congestion returns that makes their inclusion indispensable in a traditional balance portfolio: the art of diversification.

Uncorrelated returns are probably the dirtiest words in finance, not because it is something to be avoided (far from it), but because its misuse (or rather abuse) periodically leaves investors nursing portfolio losses after every market crash. Statistical correlation is simply not a good metric to assess how a portfolio will fare in a stressed environment; correlations are neither stable nor accurate. Given certain asset classes were pushed to stratospheric valuations by central bank intervention, how confident can one be that bonds will protect the portfolio if confidence in central banks falters? How does the traditional balanced portfolio behave in an inflationary or deflationary environment? These are existential portfolio management questions that are too great of a magnitude to be left to the vagaries of a historical correlation statistic. And this is where congestion returns come in.

John Maynard Keynes may not have appreciated the significance of the first structural return, and it would take some 85 years before an investment process would focus on this space. Yet we now find ourselves with markets that have never been so exuberant and yet so fragile and interconnected simultaneously. However, cometh the hour, cometh the man. Congestion returns cut a different path and allow the allocators to invest away from macro, away from the Fed and its market support. In many ways, they are the only true alternative return.