“Volmageddon” entered the financial lexicon in February 2018, a word that blends destructive connotations of Armageddon with the explosive dynamics of market volatility. A fitting new word, if ever there was one, to describe a one-day event that had no forewarning and no trigger, yet in a few hours, destroyed a whole substratum of investors – those that played the short volatility carry trade. Yet, as we scan the investment world today, the rise of the zero-day option market has led many to suggest that this black swan event may return, and this time, the collateral damage could spread beyond a niche within the volatility market. Does history rhyme or repeat?

The VIX volatility carry trade

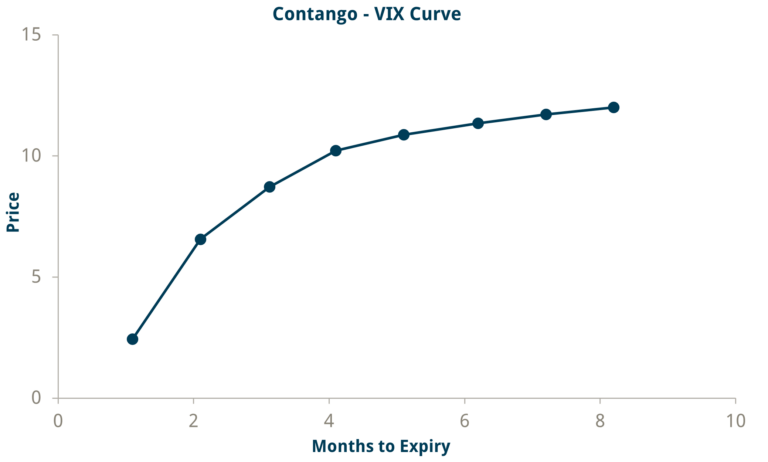

Selling volatility has always been a very seductive trade, and with the advent of the VIX futures market, it has opened up to a broader investor base. The price of volatility should be thought of as representing the cost of hedging: as the future becomes more uncertain the further you go out, the cost of hedging further out into the future should rise. This is precisely the the fundamental relationship we see embedded in VIX futures’ curve. This fundamental characteristic has led to very steep volatility curves, and where there is a slope, there is a carry trader.

Investors would routinely sell VIX futures and pick up the carry as they rolled down the curve to maturity. This has always been a magnificent carry trade: investors sell tail risk and receive a handsome premium for their troubles.

Based on Dummy data. For illustrative purposes only.

Yet, in the complete absence of any macro shock, everything went wrong in Volmageddon.

The trade had become so popular that the substantial open interest on the short side had become too developed. Short VIX ETFs were dominating the market volumes, and, for no material reason, a short squeeze occurred. The VIX exploded intraday as investors tried to buy back and cover their positions all at the same time.

The short VIX ETF market and countless investors were wiped out. Yet six years later, we are seeing once again market participants being short volatility in increasing volumes, but this time indirectly via the zero-day options market.

Zero-day options market

The VIX market, in comparison to the zero-day option market, is a pure volatility market where the price of a VIX future is not path-dependent on the S&P. All the short-selling participants in VIX futures are selling volatility outright, and all their risk comes from volatility moves.

The vast majority of market participants that are short volatility in the zero-day options market (both retail and institutional investors), are selling unhedged daily options in the hope that the option will expire worthless by the end of the day.

Volatility is a major component in the pricing of any option, and so for any short option trade, the investor will be short volatility. As volumes have exploded in this market, many recent articles in the FT, WSJ and Bloomberg have inferred that this huge build-up in short volatility exposure is a disaster waiting to happen, that a volatility short squeeze could appear from nowhere in a nasty repeat of Volmageddon.

The risk of a blowup is genuine, but it will not be in vol space but in the gamma space.

A “Gammageddon”, if you will.

Gamma versus volatility

For an unhedged option exposure, investors’ biggest risk is delta [the sensitivity of the option to the underlying share or index price], and when the option is very short-dated, gamma (rate of change of delta) is a close second.

For these short-dated unhedged options, a move in implied volatility has very little impact on investors’ portfolios relative to the loss that can occur due to the delta/gamma risk. A sudden move, or worse – an accelerating move, in the S&P price can be disastrous. The rush to close out positions, enter hedges, etc., from a sudden move is where the problem would originate. This is not a volatility problem but a gamma problem.

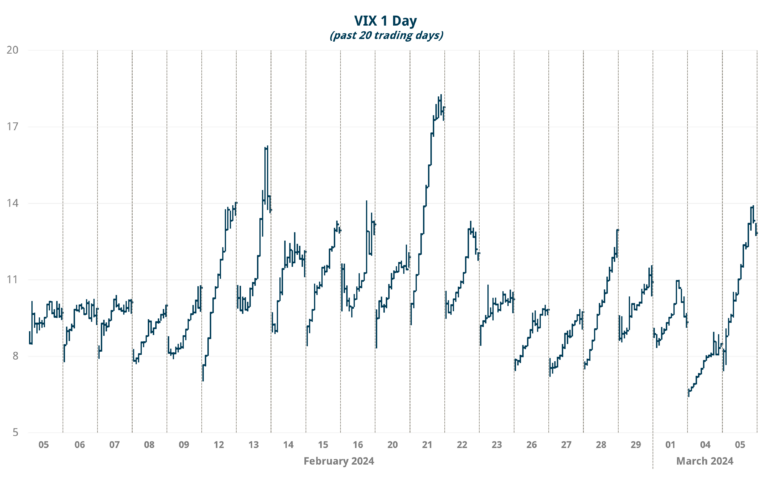

Implied volatility levels in the one-day options market regularly double (see below) and often spike intraday with no associated short squeeze dynamics. If this were to happen every day in the VIX market, no investors would still be alive to play. Yes, market participants in the zero day options market are short volatility from a technical perspective, but this risk is inconsequential when compared to the short gamma profile.

Source: Trium Capital LLP & Bloomberg

The volatility (or average price) of the one-day options market rises towards the end of the day, as investors selling options near to the close require larger premiums since even a small move in the S&P can lead to large volumes of options expiring ITM or OTM. Sellers need to be paid more as the market draws to a close as this is when the gamma risk is highest, and hence, the average price (or implied volatility) of the option market rises.

These large swings in intraday volatility do not phase market participants (because investors are selling gamma, not volatility, even though they perhaps don’t realise it).

It is worth exploring the dynamics of how swings in gamma could cause a blowup.

How could ‘Gammageddon’ play out?

As we saw with Volmageddon, volatility pricing can sometimes be independent of what is going on with wider equity markets. However, gamma risk is always dependent on the underlying share/index price, as the equity price will determine whether the option expires worthless or in the money. Hence, gamma risk is always path-dependent on the underlying share/index price. This path dependency implies the investors’ gamma risk will change throughout the day as the underlying index price moves. as will the (opposite) gamma risk of those market participants on the other side of the trade – usually taken by brokers/banks.

Typically, brokers start the day by being long gamma, and if the market starts falling, they will reduce their gamma position by buying equity futures. This gamma hedging will tend to dampen any small S&P moves while also creating a very noticeable intraday reversion effect (buy the dip).

For larger S&P moves, the gamma profile of any particular broker could switch to negative, depending on their OTM option book makeup. (i.e. how much deep out-the-money options they have bought versus at-the-money options.) If a negative gamma profile develops across all the brokers/banks, their aggregate gamma hedging activity could switch from ‘buying the dip’ to chasing the momentum. They could all start selling/buying in the direction of the market simultaneously.

Each broker’s gamma profiles (i.e. how their gamma risk changes as the index price moves) on any given day will always be different, and it is impossible to know whether this path dependency aligns across the street. Theoretically, at least, an alignment would most likely occur after a gap risk event (a sudden macro shock). In such an event, the mean reversion dampening effect that brokers/banks usually provided by their hedging activity could quickly switch into a downward momentum chase.

Panicked option traders would add to this accelerating doom loop, a gamma short squeeze would ensue and “Gammageddon” would be born.

Final thoughts

Volatility selling is just too profitable to ignore, and after every short volatility squeeze, investors always return time and time again. We see that in the aftermath of Volmageddon, some retail speculators have returned to the VIX market, yet the volume of the short VIX carry trade is a shadow of its former self. Retail investors have a new toy to play with: gamma selling in the zero day options market.

Gamma selling is equally just as profitable (and a very similar trade in terms of return profile), and so far, so good, no blowups. With no collective memory of financial loss, seductive returns and a new crowd of speculative retail investors, it seems that gamma selling in zero-day options has cannibalised the short interest in VIX.

The trade is different, but the story is the same: only time will tell if Gammageddon takes its place in the pantheon of financial disasters.