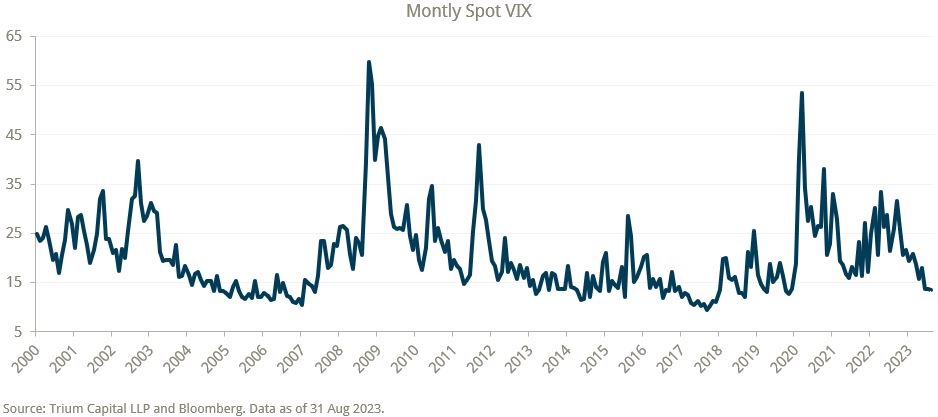

We often get this same question: How do we expect Merger Arbitrage to perform in varying volatility and market environments? To this end, in this article, we review historical and empirical evidence to highlight the neutral nature of Merger Arbitrage and the opportunity set that we see in different volatility environments.

Equity Volatility & Merger Arbitrage

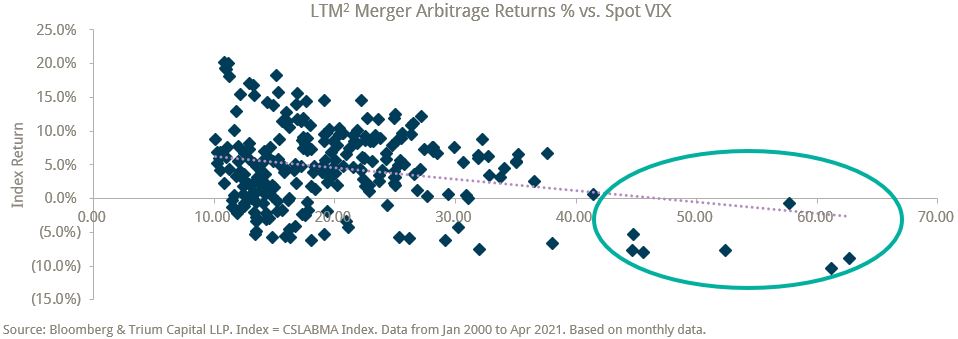

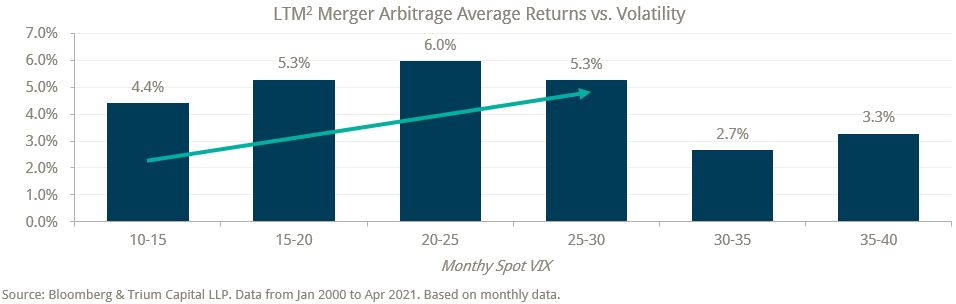

Merger arbitrage is often grouped with other “short volatility” strategies. There is some truth to this characterisation, but there is significant nuance. Merger arbitrage returns1 will suffer during periods of extreme volatility – at extreme levels, downside and completion rates are both impacted significantly, and merger arbitrage returns suffer accordingly:

Although these periods of extreme volatility comprise only 3% of the months since 2000, the potential impact can be material to an otherwise uncorrelated return stream. Fortunately, these periods are typical tail risk events, and cost-effective hedges are available. Combining tail risk hedges with strict risk management can mitigate a significant portion of this risk.

However, what is also interesting is that, for the remaining 97% of the time outside of these extreme cases, merger arbitrage has an unexpected relationship with volatility:

At VIX below 30, there is a positive correlation between volatility and merger arbitrage returns. There is, in fact, a good reason for this: during periods of middling volatility, merger arbitrageurs can capture a bigger “premium” for underwriting deal risk through wider spreads, but historically, deal completion rates are not impacted by a modest increase in volatility – allowing arbitrageurs to capture better returns.

This positive correlation was particularly evident in the months following March 2020 as volatility remained at relatively high levels. The elevated anxiety in the market is leading to significant “premiums” being offered to underwrite deal risk, even though deal risk started to subside by the end of the year.

VIX as a forward indicator of Merger Arbitrage Returns

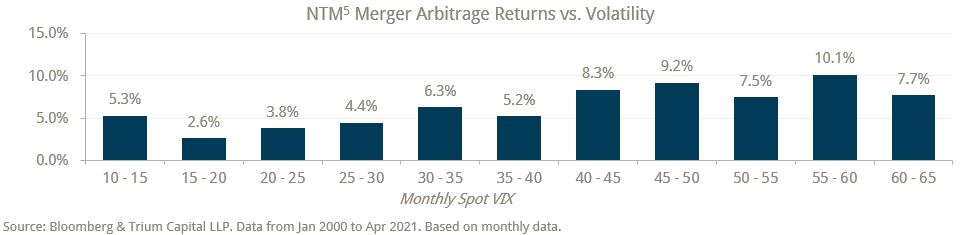

If there is indeed a positive impact of higher volatility, as markets settle and the VIX declines, should we expect forward returns to decline as well? If we instead plot the forward-looking returns against VIX, a remarkable picture emerges

Forward-looking returns provide an even clearer picture of the positive correlation between volatility and returns available in the universe3. Even during periods of extreme volatility, the forward-looking return will rise and remain positive, as the market quickly reprices risk4. As such, a decline in volatility is likely a headwind for returns, at least in the medium term.

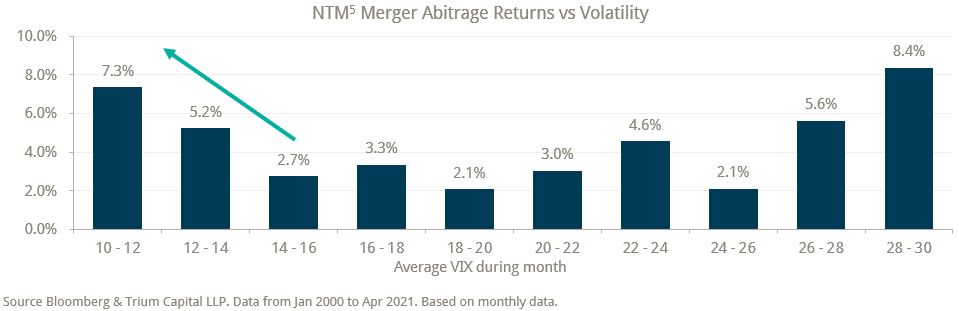

One interesting side note is that the correlation seems to break down at the low end of the volatility range, with expected returns rising again when the VIX falls below a certain point:

It is unclear what drives this increase at lower levels of volatility, but we believe this might be due to technical factors since our data again shows no discernible difference in completion rates. Spreads are likely wider due to increased competition for capital during these periods as many other hedge fund strategies that might otherwise be too volatile or too unpredictable suddenly become attractive when the market becomes complacent about volatility. As such, if we return to a sustained period of very low volatility, a tailwind may yet emerge.

___________________

1In this note, we use an equal-weighted index (CSLABMA Index) of all merger arbitrage deals as a proxy for merger arbitrage returns.

2LTM is the Last Twelve Months.

3By looking at forward-looking returns only, we are essentially focusing on the opportunity set at that point in time only.

4The rate at which the market has historically priced risk as volatility levels change has significant implications for how we manage our risk.

5NTM is the Next Twelve Months.