The two debt situations are very different in the sense that, unlike previous financial crises, the US debt risk is now coming from the public debt stock rather than the private one, while in China, it is the opposite – the risks are in the private sector. That means that in both cases, there are almost ‘direct’ stabilisers which can kick in before the risk really gets out of control.

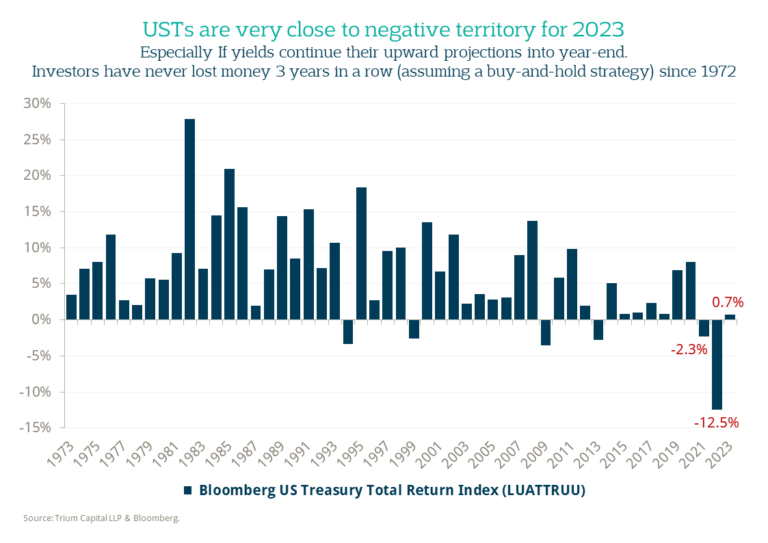

In the US, this is in the form of Yield Curve Control, a process which the US went through after WW2, and which is now relatively easier to implement given more than a decade of Fed involvement in the US Treasury (UST) market in the form of quantitative easing (QE). In China, given the non-market nature of its economy and the prevalence of implied government guarantees in various sectors, a systemic risk is also less likely to materialise.

With these caveats in mind, should the global economy go through an environment in which one or both events transpire, the effects will nevertheless reverberate throughout asset classes.

If we look at history, the largest effect of higher US yields (and a steeper yield curve) is on the USD, which tends to strengthen. The effect depends on the speed with which yields move – anything more than c. 25bps move higher in UST 10yr per month will cause EM FX to sell off – as well as the nature of the move – growth vs. inflation as the primary driver. We believe this time, unlike in the last four decades or so, if UST yields shoot up, it will be inflation-driven, which will naturally exacerbate the negative effect on EM FX, in theory.

However, suppose UST yields rise also on the back of a structural increase in UST term premium caused by a deterioration of the institutional framework/governance, as cited by Fitch when it downgraded US credit outlook not so long ago. In that case, it becomes a bit more complicated to assess the outcome on other assets. From a flow perspective, the US has experienced more than $5Tn of inflows since the end of the global financial crisis in 2008. If some of that flow starts to reverse, then the USD may weaken, and foreign assets, including many EMs, may benefit.

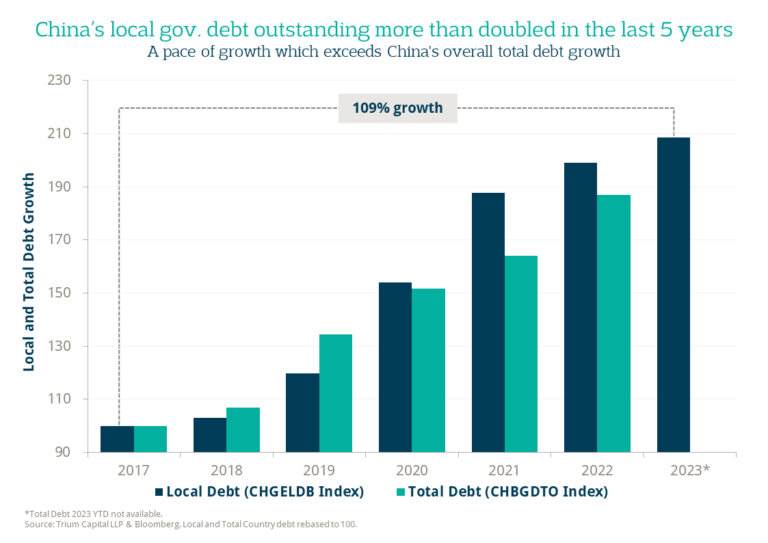

The risk in China, we believe, stems not from the property sector, whose assets have already deflated c. 80%, and also not from the banking sector, as banks are well capitalised. Instead, it’s from the local government sector, particularly from the local government financing vehicles (LGFV). LGFV debt comprises almost half of the domestic onshore bond market and there have been no defaults yet (though there have been missed commercial paper payments by some LGFVs). Should a default occur, it will have reverberations across the whole Chinese economy, and it will make it more difficult for central authorities to cover those risks.

Unlike in the US, where a debt crisis will have a direct flow effect, the effect on the global economy from a China debt crisis will be only secondary through the trade channels (foreign investors have very little exposure to Chinese assets). In such a scenario, we expect all domestic Chinese assets to underperform. However, ironically, because of the closed capital account, we may see a situation in which Chinese equities outperform, as retail money flows from the property and bond market into stocks. Should this China risk materialise alongside the UST risk above, the effect on CNY becomes a little less clear.