The weakness of the Japanese Yen (JPY) is becoming disorderly to the extent that it is starting to worry the Ministry of Finance (MOF), prompting it not only to ask the Bank of Japan (BOJ) to intervene directly in the currency market but also putting pressure on the Central Bank to expedite and increase the pace of interest rate hikes. The only problem is that a stronger JPY and higher interest rates directly impede BOJ’s efforts to break for good from Japan’s decade-long disinflationary vicious cycle (price stability is, after all, BOJ’s primary mandate). For investors’ positioning in the Japanese markets, it is essential to understand how this ‘conflict’ between the MOF and the BOJ eventually plays out.

JPY is cheap by any measure

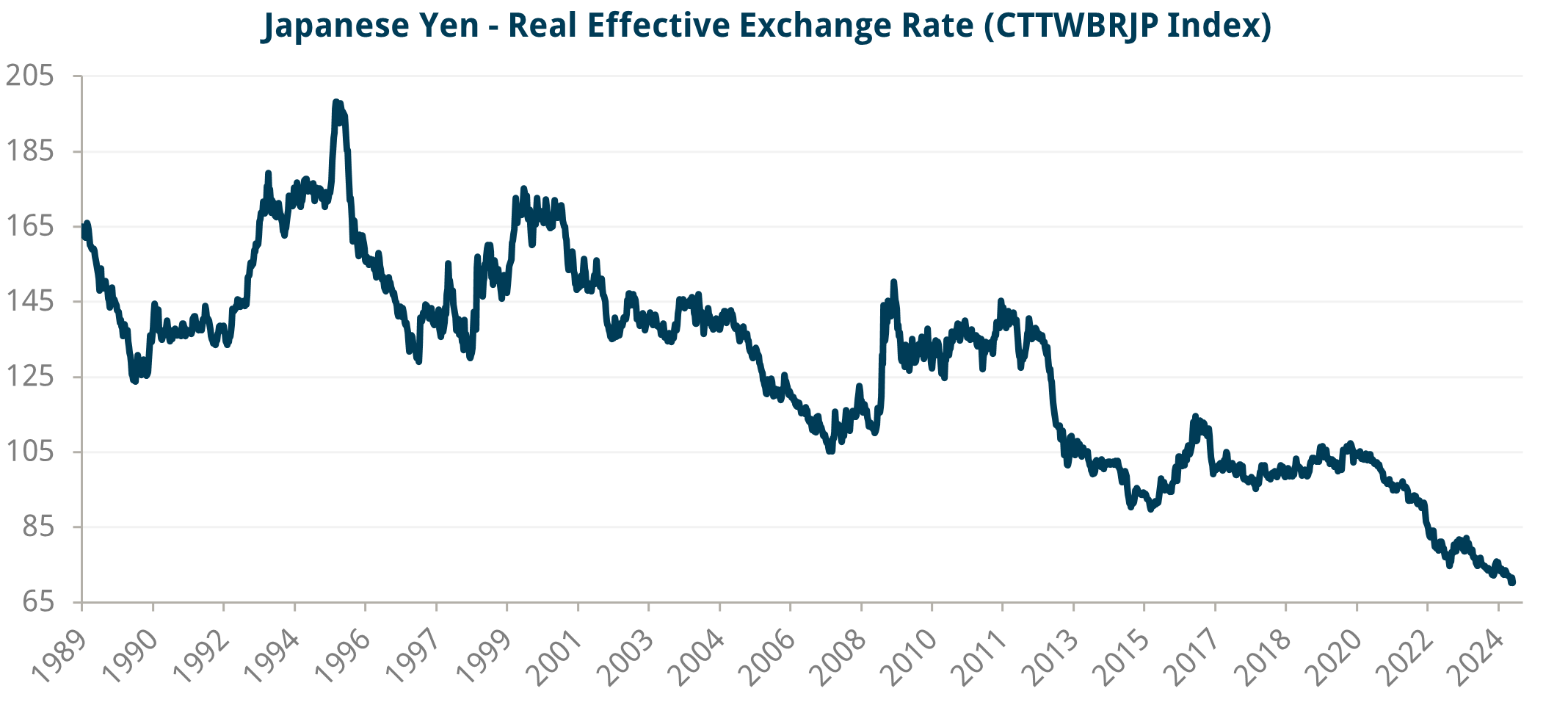

The Yen looks cheap based on any fundamental metrics. For example, according to the Real Effective Exchange Rate (REER), as of May 13 2024, the Japanese currency is at the cheapest level since at least 1989.

Source: Bloomberg. The real effective exchange rate (REER) is the weighted average of a country’s currency in relation to a basket of other major currencies.

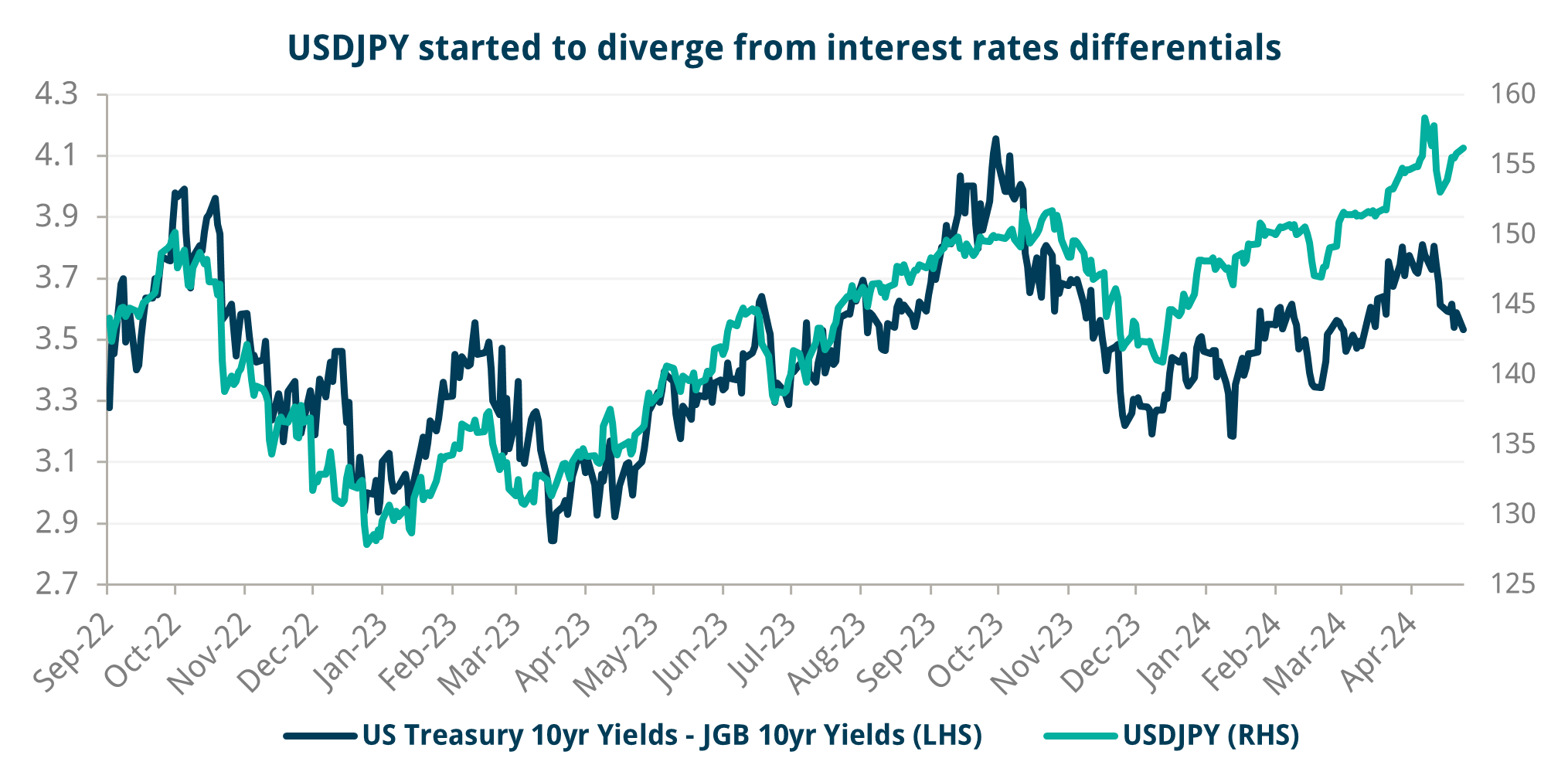

In addition, USDJPY seems to have diverged from short-term portfolio flow metrics, like interest rate differentials. For example, the divergence started already appearing at the beginning of April 2024 but became particularly pronounced after the BOJ intervention in early May.

Source: Bloomberg

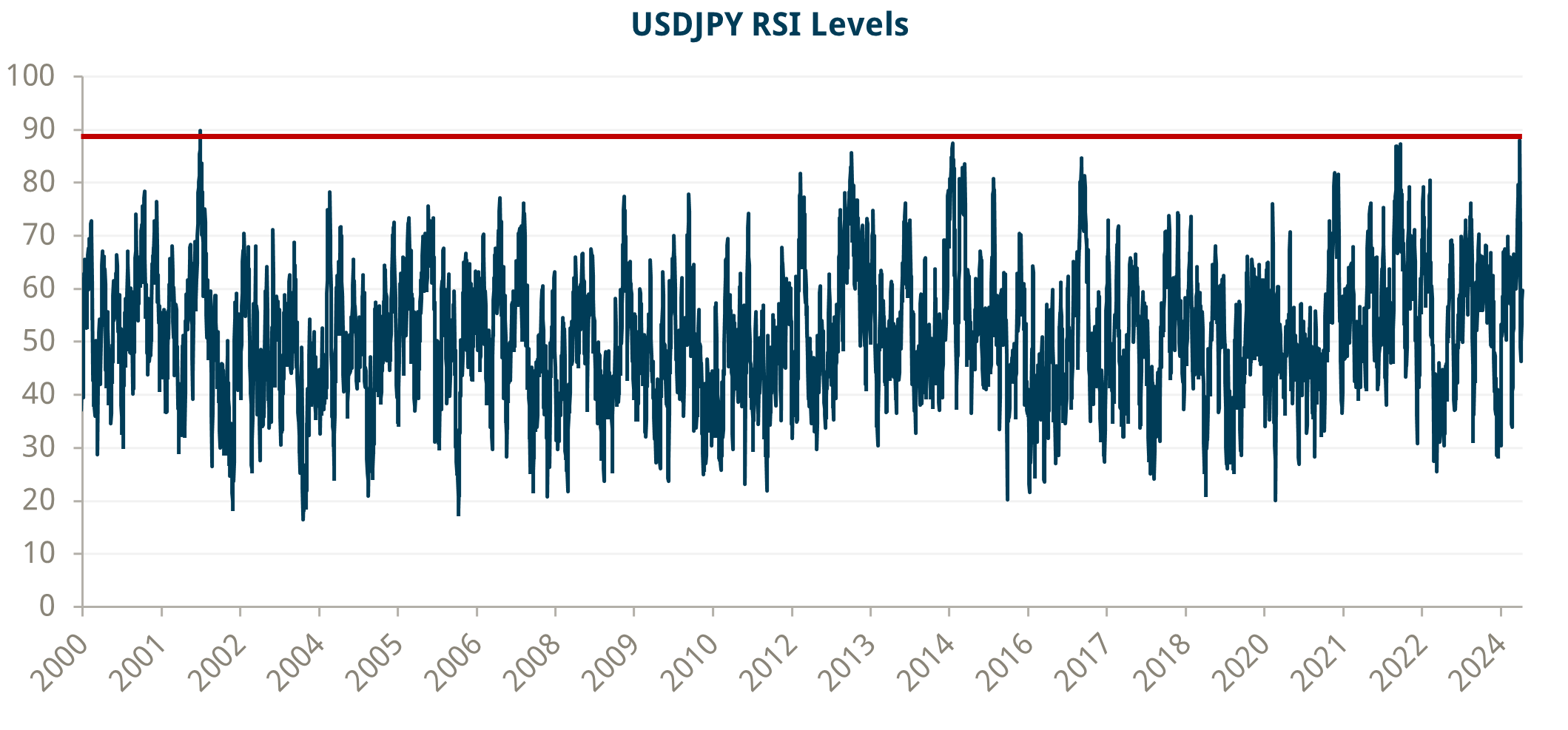

Finally, at the end of April, USDJPY reached overbought levels not seen since December 2001.

Source: Bloomberg

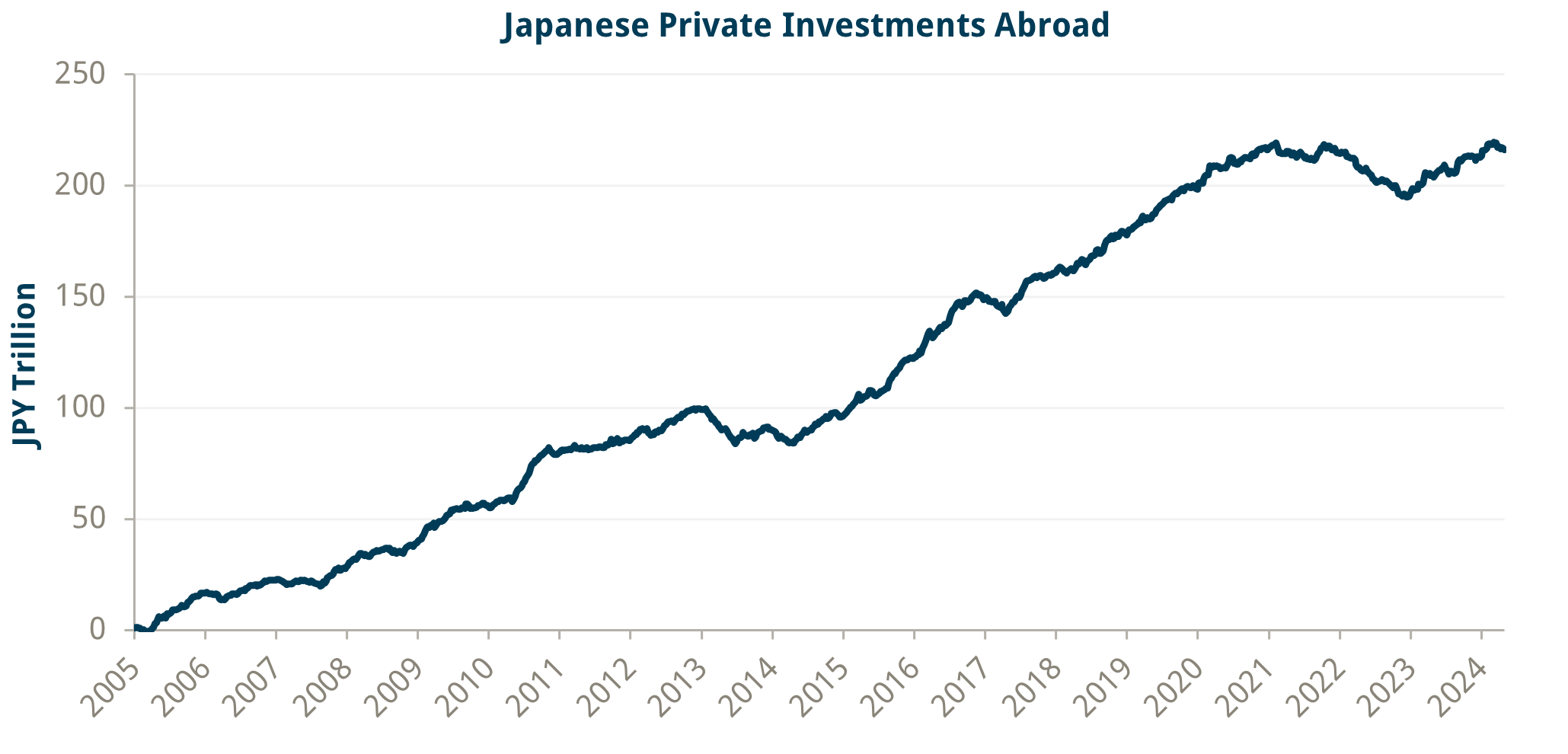

These were some of the technical reasons why the MOF eventually instructed the BOJ to intervene and buy JPY in the open market. However, in our opinion, the MOF has other more structural reasons for wanting to see the Japanese currency stable, at the minimum. Facing exceptionally low returns on capital at home, thanks to the zero/negative interest rate policy the BOJ pursued to inflate the economy and meagre prospects for equity capital appreciation, Japanese private capital has chosen to invest abroad.

Source: International Transactions in Securities: Ministry of Finance (mof.go.jp)

The chart above shows the cumulative flow of Japanese institutional investments in bonds and stocks abroad since 2005. At the current USDJPY exchange rate, about $1.4Tn has been invested abroad. Moreover, after reaching a record high in 2021 and a temporary decrease into 2022, Japanese institutions have started again to diversify overseas, with the cumulative total approaching the 2021 record high.

This private capital exodus abroad seems to have been a clear trend in the last two decades. One would have thought that the prospect of Japanese interest rates finally succumbing from negative territory would prompt some structural reversal. Indeed, there was such a reversal between 2021-2022, but the trend resumed after that, and this time it was driven by prospects of a continuously weakening JPY. The shocking part is that the MOF & BOJ intervention in the Autumn of 2022 did not seem to have affected this capital flight trend at all.

A cheaper currency can help a country improve its external imbalance (not that Japan has such a need) or revive its economy (by ‘borrowing’ demand from abroad), thus potentially pushing its inflation rate higher (Japan would benefit from this). A trend of constant currency depreciation can pretty much do the opposite – wreck a country’s economy by undermining trust in its institutional and governance frameworks (many emerging market countries can attest to that, especially those with a large debt stock, like Japan). It is likely that some Japanese government officials, those at the MOF, may fear presently that the currency depreciation trend would hit such a point of no return unless something is done to promptly stem or potentially even reverse it.

Prime Minister (PM) Kishida meets BOJ Governor Ueda

The BOJ, on the other hand, does not seem to have such concerns. For more than two decades, policymakers at the Central Bank have unsuccessfully tried to achieve their main mandate of price stability by getting the Japanese economy out of the spectre of disinflation. They came close at various points in the past, but their efforts have come to nothing due to either external events (GFC, European debt crisis) or domestic politics (increasing VAT, for example).

And then, in the early 2020s, we had the confluence of the Covid crisis and geopolitical tensions disrupting global supply chains and providing the structural base for a shift in the low inflationary period globally from which Japan also naturally started to benefit. Moreover, the Japanese currency started to weaken, fuelling the fire of Japanese inflation. This is ‘manna from heaven’ for the BOJ – a Japanese Central Bank Governor could realistically fulfil his primary mandate for the first time. BOJ governor Ueda is not going to let that slide, will he?

Last week, there seemed to have been a ‘routine’ meeting between PM Kishida and BOJ Governor Ueda. What was not routine, however, was that after the meeting, the governor’s tone concerning the currency’s effect on inflation suddenly changed. Only 11 days before, at the BOJ policy meeting, Ueda had said that “the yen’s recent fall did not have an immediate impact on trend inflation”; after the meeting with the PM, the governor said that “BOJ may take monetary policy action if the yen falls affect prices significantly”.

Two days after meeting PM Kishida, the BOJ released the Summary of Projections from its April 25-26 policy meeting, where some policymakers expressed the view that interest rates may rise more than priced in the forward market. Then, on May 13, the BOJ unexpectedly reduced the amount of JGBs it purchased at its regular auction. Now, all this could just be the BOJ naturally reacting to the sudden move in the currency after the policy meeting on April 26: the reduction in the JGB purchases, though strange, is still within its stipulated range. But, as mentioned above, such actions really go against the BOJ fulfilling its price mandate, and it is too much of a coincidence that they happened after a meeting with the government, which is more focused on the bigger picture of ‘holding’ the economy together.

What does this mean for JPY?

MOF ultimately controls the currency and only instructs the central bank to transact on its behalf. As such, policymakers have already shown their card, and anyone who knows or has dealt with Japanese officials, once they have embarked on a project, they will keep going at it until it is complete or they have run out of options, sometimes, even if only out of ‘pure pride’.

The BOJ technically controls interest rates, and as we have established, it is somewhat reluctant to raise them, as that goes against its mandate. However, a central bank is never fully independent from the government, and there is inevitably some pressure on the BOJ to be more hawkish. Therefore, if a hawkish BOJ does not stem JPY weakness (it has not so far), and if interest rate differentials are any guide (see above), then MOF/BOJ will embark on another round of intervention.

Empirical literature shows that unilateral foreign exchange intervention seldom works, though, to be fair, most of the studies are done for emerging market countries with limited FX reserves. Japan not only has a sizeable official stock of USDs, but it can also harness, in theory, the private stock of USDs (though then it may have to impose some kind of capital controls, which will then become really messy). Moreover, it can quickly get a swap line from the Fed, with the intervention effectively becoming dual, and the chance of success increases substantially. So, Japan has options and thus still has an opportunity to stem the weakness of its currency.

What about Japanese rates?

The BOJ can sound hawkish, but we suspect it will stick to its initial assessment of postponing raising rates as long as possible so as not to jeopardise its inflation mandate. However, while the very front end of the JGB curve may not move that much, yields in the back end can rise as the market continues to put more risk premium on duration. The worst possible outcome remains one of accelerated inflation, with or without JPY weakness, which becomes ingrained and pushes inflation expectations in the opposite vicious cycle to what Japan experienced before (so higher, not lower). With the stock of debt multiple times its GDP, to combat this rise in inflation, Japan will find itself trapped, unable to raise rates sufficiently fast for fear of triggering a vicious debt cycle instead.

Suppose the inflation cycle globally has turned on the back of shifting global supply chains, advanced manufacturing, AI, green energy capital investments, and geopolitical tensions. In that case, Japan will not be the only country facing the choice of a vicious inflation cycle on the one hand and crippling debt payments on the other. However, while in the preceding three decades, it was emerging market countries that had to face that predicament, in the years to follow, it would be mostly developed countries because they are the ones that have substantially increased their debt stock. Still, Japan may be the first one that the markets would force to act either way.